|

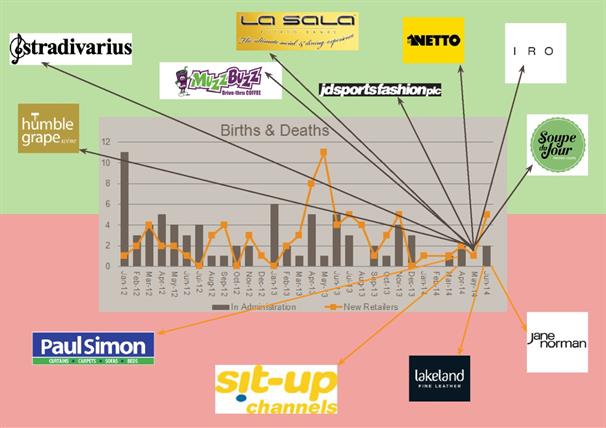

Which new names have we seen join the UK’s retail market and which retailers have fallen into administration over the last quarter to June 2014?

We’ve seen new retailers across the growing market of Food. From drive-through coffee to wine bars, there’s a lot of new names to learn in the F&B sector at the moment as international brands make their UK debuts or new retailers start up. In the ever more competitive grocery arena, discounter Netto joins the lower end of the market alongside the likes of Aldi and Lidl – which can only mean more pressure for those squeezed in the middle, like Tesco. Fashion is another sector seeing a trend of new names – a sign of growing consumer confidence as widespread terror over the state of the economy fades?

Four retailers have fallen into administration in this quarter, across fashion, TV and home furnishings. The trend is clear: those retailers who aren’t adapting to the changing shopping climate in the UK are struggling and won’t survive the competition.

In some cases, like for Paul Simon, a large part of the problem was failing to adopt an effective online offering – with their transactional website inefficient and not cost-effective. When their stores were hit by a drop in sales as a result of the flooding this year – having a strong web presence could have helped balance things out. As it was, they couldn’t weather the storm. In other cases, the problem lies fundamentally with the in-store offering as with Jane Norman. The fashion retailer has struggled for several years in the challenging and competitive sector, finally succumbing to administration for the second time in three years due to lack of a turnaround in-store, although its website will likely continue trading.

Ultimately it comes down to ‘customer experience’: both online and in-store – you can’t ignore either channel anymore – creating a unique and positive experience for your shoppers is imperative.

Let’s look at the Q2 births and deaths in more detail…

April

A balanced month: in April we saw two retailer births, while two fell into administration…

IRO

Who they are: IRO is a French young fashion brand, operating across the USA, Europe and the UAE, positioned in the upper-middle sector of the market. It currently operates concessions within department stores in the UK, including Selfridges, Harvey Nichols and Harrods.

What’s happening: IRO will make its standalone store debut this summer with the opening of a flagship store in West London. Cushman & Wakefield have been appointed to find more suitable locations around the capital as the brand looks to expand further.

In the news:

o IRO to open flagship store in Brompton Cross

Soupe du Jour

Who they are: Soupe du Jour is a new restaurant and take-away concept, co-founded by Charles Paillé de Rivière and Daniel Auner. It offers a range of traditional fresh soups with a modern twist, and is positioned in the middle of the market.

What’s happening: The brand opened its debut outlet in London’s Soho in April and is aiming to expand further, with Shelley Sanderz, who secured the launch site, looking to identify further ones.

In the news:

o Soupe du Jour opens debut outlet

Paul Simon

Who they are: Established in 1990, Paul Simon is a home furnishings retailer, which at its height operated over 50 stores across London and the Home Counties as well as an online shop.

What’s happening: In April Paul Simon fell into administration due to issues with its online offering and the floods earlier this year which hit in-store sales. Deloitte, appointed administrator, initially said the company would continue to trade while a buyer was sought, but later announced the closure of 17 stores by the end of the month. In May, Lewis Home Retail acquired seven Paul Simon stores, while eight others were closed – followed by the announcement that the remaining 22 stores would also close by mid-June.

In the news:

o Paul Simon to close all 22 remaining stores

o Lewis Home Retail acquires seven Paul Simon stores

o Deloitte to close 17 Paul Simon stores

o Paul Simon falls into administration

Sit-up TV

Who they are: Founded in 2000, Sit-Up TV is a television retailer with three auction-style shopping channels: bid.tv, price-drop.tv and speedauction.tv. In its earlier years it appeared in The Sunday Times 'Fast Track 100' list as the fastest growing large company in the UK and for two consecutive years it was named in the Financial Times’ 'Top 50 Creative Businesses' list.

What’s happening: In April, Sit-up TV collapsed into administration after seeing a significant drop in sales at the end of the first quarter. Its TV channels Price Drop and Bid TV have both ceased transmission, with its online shop also closing and over 200 employees losing their jobs.

In the news:

o Sit-up TV enters administration

May

A quieter month: in May one new retailer emerged…

Muzz Buzz

Who they are: Muzz Buzz is an Australian drive-through coffee concept, currently operating 60 stores across Australia. Hand-made coffee is served fresh to drivers alongside a full ‘food to go’ offering, with stores designed to be easily accessible and highly efficient.

What’s happening: The UK company, a joint venture with the Australian parent, is planning an ambitious regional roll out across the country, with initial expansion focused in the Midlands and the first units set to open there this year. The chain is eventually looking to open up to 200 stores across the UK, which comes as they are also looking to expand their Australian store portfolio to more than 200 over the next five years.

In the news:

o Muzz Buzz plots UK regional roll-out

June

An exciting month: in June five new retail names entered the market and two faced administration…

Stradivarius

Who they are: Stradivarius is a womenswear retailer, focusing on young individual fashion, which currently operates in 60 countries worldwide, including Ireland.

What’s happening: The brand is set to open its UK flagship store at Westfield Stratford City before the Autumn, following the successful launch of a UK e-commerce site last year.

In the news:

o Stradivarius to open debut UK store at Westfield Stratford City

Humble Grape

Who they are: Founded in 2009, Humble Grape is an independent wine merchant and tasting event group, specialising in high-quality boutique wines from small, family-owned vineyards and wines imported directly from France, Italy, Spain and Australia.

What’s happening: In June, Humble Grape announced plans to expand onto the high street and open 60 franchised “experimental” wine bars by 2020. The first will be located in London’s Shoreditch, with a wine bar and retail offering aiming to enhance the customer experience through technology.

In the news:

o Humble Grape to become 'Starbucks of the wine world'

La Sala

Who they are: La Sala is a Spanish restaurant-bar operator positioned in the upper-middle range of the market, making its debut in the UK ahead of plans for wider expansion here.

What’s happening: In June it was announced that La Sala had secured its first UK site on the Chigwell Road in London – it’s first venture outside of Spain. A second location, possibly in west London, is under consideration while further sites are still at planning stage.

In the news:

o La Sala secures debut UK site

Netto

Who they are: Netto is a discount supermarket founded in Copenhagen and operating across several European countries. The chain has operated in the UK before: between 1990 and 2011 Netto operated across the country, but in 2010 sold their entire UK store portfolio to Asda, which re-branded all stores to the Asda fascia by the end of 2011

What’s happening: Last month, Netto’s return to the UK in a joint venture with Sainsbury’s was announced, with 15 trial Netto stores expected to open here by the end of next year. They are targeting an area of the North of England for the comeback, with the first store planned to open there before the end of 2014.

In the news:

o Netto outlines area for 15 trial stores

o Netto appoints UK marketing director

o Sainsbury's launches joint venture with Netto

Open

Who they are: Open is an own-brand value fashion concept from JD Sports Fashion Plc, announced in January this year. Prices are expected to be similar to H&M, New Look and Primark, and the clothing range will be more fashion forward compared to JD Sports’ sportswear. This is not the first time JD has pushed the Open fascia; fingers crossed it works well this time.

What’s happening: The first Open stores are set to open in various locations across the UK in September.

In the news:

o JD Sports to launch first Open stores in September

Jane Norman

Who they are: Founded in 1952, Jane Norman is a womenswear retailer focusing on young fashion, operating 65 stores and concessions in the UK as well as having an international presence through franchises and concessions. Jane Norman fell into administration in June 2011, before Edinburgh Woollen Mill rescued 31 stores.

What’s happening: In June it was announced that the struggling retailer had fallen into administration for the second time in three years – with store closures looking inevitable, although its website and international concessions look likely to continue trading.

In the news:

o Jane Norman falls into administration for second time in three years

Lakeland Leather

Who they are: Lakeland Leather is a womens and menswear retailer, which has traded since the mid-1960s when it opened its first store in Ambleside and now has 22 stores across the UK, including a number of factory outlets and an e-commerce platform.

What’s happening: In June Lakeland Leather collapsed into administration, which the retailer blamed partly on the mild winter which saw sales of certain product ranges struggle. With over 200 jobs at risk, it is understood that a deal may be in place to try and rescue some of the stores, although four have already closed.

In the news:

o Lakeland Leather calls in administrators

|