|

|

Retail Spotlight – Dwell ceases trading |

| |

Posted At: 21 June 2013 11:10 AM

Related Categories: Administrations, Retail, Retailers, Store Closures |

| |

Following a cash-flow crisis and failed attempts to find a buyer or secure fresh working capital, Duff & Phelps were appointed as administrator to the furniture chain, Dwell.

SnapShop now brings to you an overview of the retailer’s trading over the years and highlights of the collapse.

To us it looks like a typical case of biting off more than you can chew – in the last two years the retailer opened over 9 new stores and had plans to open around a hundred or so more in the future.

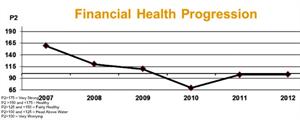

Financial indicator, P2 improved marginally in 2011, but not to the extent of indicating sustainable health, whilst there has been no measurable return on trading assets in the past three financial years. The latest accounts showed an over-reliance on creditors, a shortage of working capital which may have inhibited sales and despite securing a significant level of refinancing, it’s possible that new store openings at high cost locations may have resulted in the final blow.

20th June 13 - Dwell closed all 23 stores and ceased trading both on the High Street and online with immediate effect - resulting in the loss of 300 jobs. Read more

13th June 13 - Dwell insisted that it is continuing to trade as usual, amid speculation that it is on the brink of administration.

7th June 13 - Future of Dwell was close to being decided after appointing Argyll Partners to explore option.

29th May 13 - Dwell appointed Argyll Partners to explore its options, including the possible sale of the business.

28th Feb 13 - The 52 week period ending 27 Jan 12 represented a successful period, with the company generating sales growth of +3.3% to £34.5m. During 2012, the company successfully opened six new stores, increasing the number of stores to 24, and these are already making a positive contribution to the company. The stores were in Guildford, Cardiff, Leeds, Lakeside Thurrock, Staples Corner (North London) and Birmingham (Bullring).

Key:

P2>175 – Very Strong

P2 >150 and <175 - Healthy

P2>125 and <150 – Fairly Healthy

P2>100 and <125 – Head Above Water

P2<100 – Very Worrying

14th Nov 12 - Dwell appointed Rebecca Cotterell as its new managing director, replacing founder Aamir Ahmad who stepped down from the role.

28th Aug 12 - Retailer appointed a Director of Multichannel as it seeks to improve its online offering.

1st June 12 - Dwell saw the scope for up to 100 stores as it looks for smaller, quirkier shops.

13th Dec 11 - Dwell agreed a lease on a store at St David’s shopping centre in Cardiff, which will be its first outlet in Wales.

18th Nov 11 - Dwell has bounced back into the black at an EBITDA level as sales grew in the year to January 28 despite a punishing big-ticket market.

2nd Nov 10 - Dwell signed up at Lend Lease's Touchwood shopping centre in Solihull.

3rd Sept 10 - Dwell set out a 33-store expansion plan after securing a £5m investment from a private equity firm.

SnapShop subscribers can view retailer profile, more historic news, accounts and financial standing over the years, by visiting Retailer Directory here.

To stay up-to-date with retail administrations, new retailer entering UK and news please subscribe to SnapShop online at any time or register to receive information packed newsletter for 3 months.

|

|

|

|

Retail Update - June 2013 |

| |

Posted At: 20 June 2013 11:16 AM

Related Categories: Retail, Retail Statistics |

| |

Although June has seen no reported administrations, the future of a number of high-street brands is hanging in the balance.

• Up to 20 Republic stores face closure after the proportion of landlords willing to agree to the new, softer terms proposed by new owner Mike Ashley’s Sport Direct fell short of the 75% stipulated by the group. As a result, Republic’s outlet in The Lanes shopping centre in Carlisle is to close before the end of the month. The whole chain could still be closed.

• Embattled furniture retailer Dwell has lined up Duff & Phelps as administrator after appointing advisers to explore options for the chain, which includes a pre-pack administration and would continue the on-going demise of the high street.

• Jane Shilton’s future is also in jeopardy after takeover talks with Shoon collapsed following heated discussions between the two parties and a difficult year for the footwear industry as a whole. Jane Shilton made a pre-tax loss of £1.9m for the year to 30 June 2012, and followed the previous year’s loss of £575,000.

Following the administration of Coggles in May, it has been confirmed that the Hut Group has completed its acquisition of the company’s assets including its stock and all intellectual property. As a result, all stores have been closed as Coggles will now continue as an online-only operation within the group’s portfolio.

The iconic King’s Road Sporting Club is to close its doors after 20 years of trading, although reasons behind its as-yet-unknown closure date are unclear. It is believed to still be making a profit, and is understood that the freeholders of the property are behind the decision.

In other news, shopping centre developments throughout the UK are restarting for the first time since the collapse of Lehman Brothers, having been previously frozen amid fears that the economic conditions would dampen demand from retailers. Projects in Glasgow, Leeds, Bracknell and Bradford look set to get off the ground having signed up anchor tenants to their schemes. A total of 40% of the development pipeline is to happen in the London area, with the Battersea Power Station development finally beginning, and the redevelopment of Croydon’s Whitgift centre. Developments at Wembley, Earls Court and King’s Cross are also underway.

And finally, Bill Grimsey has launched his own alternative review of Britain’s troubled high streets after accusing Mary Portas of giving ‘false hope’. He has assembled a team, endorsed by Asda chief executive Andy Clarke, which includes Nick Hood from Company Watch, retail commentator Paul Turner Mitchell, and LDC’s Matthew Hopkinson. The report will be submitted to the three main political parties in the autumn.

|

|

|

|

|