|

|

Retailer View - Monki |

| |

Posted At: 18 December 2018 16:00 PM

Related Categories: Retail, Retailers |

| |

Founded in 2006, Monki is a young fashion brand for women targeting 14- to 20-year olds. Monki describes its core collection ‘a flirt between expressive street style and crisp Scandinavian fashion sense’.

H&M Group acquired 60% of Monki's owner Fabric Scandinavien, which also operates casualwear retailer Weekday and denim brand Cheap Monday, in 2008 before snapping up the remaining 40% in 2010.

Monki launched in the UK market in September 2011 with the opening of a concession in Selfridges London. Although exact UK store ambitions are unknown, Monki has been growing steadily in the UK with its "Scandi cool meets Asian street style” look appealing to young British consumers. There are now seven standalone Monki stores in the UK with an outlet in Birmingham coming soon according to its website.

Monki’s unique selling point is its idiosyncratic store layout and unconventional branding.

Currently operating 115 stores in 14 markets in Europe and Asia, as well as an ecommerce site that delivers to 18 European countries, Monki seems destined to continue to grow despite the rapidly changing fashion industry.

|

|

|

|

Retailer View - Boden |

| |

Posted At: 18 December 2018 11:22 AM

Related Categories: Retail, Retailers |

| |

Founded by Johnnie Boden in 1991, Boden is a British clothing retailer selling primarily online and by mail order and catalogue.

Initially launched as a menswear retailer, Boden’s offer now includes womenswear (introduced in 1992), childrenswear (introduced in 1996), Baby Boden (introduced in 2007) and 'Johnnie b' Teenswear (introduced in 2010. Boden's UK website was launched in 1999, and trades in over 60 countries worldwide including the USA, Germany and Australia.

Boden made the move into bricks-and-mortar retailing with the opening of its debut flagship store on London’s King’s Road in November 2017. There is also another store at Hanger Green in west London, and in the first half of 2018 Boden opened its first shopping centre store at Westfield White City. Boden has further strengthened its physical presence in the UK through a partnership with John Lewis that sees an edited collection of its womenswear and Mini styles available through several stores.

Boden’s improved visibility led to a 14% rise in first-time customers during 2017. The year to 31 December 2017 saw Boden record a 13% rise in group sales to £347.1m, up from £308.3m in 2016, and pre-tax profits of £27m, an increase of £1m from 2016. The brand said the increase in revenues was driven by more customers and a rise in average spend per existing customer.

Initial results for 2018 show that sales have continued to rise – they were up 12% for the first half of the year - and with plans to continue expanding its physical presence, Boden is definitely one to watch.

|

|

|

|

Retailer View - The Entertainer |

| |

Posted At: 18 December 2018 11:20 AM

Related Categories: Retail, Retailers |

| |

Established in the early 1980s, The Entertainer is the largest independent toy retailer in the UK.

Boasting over 150 stores nationwide, The Entertainer is hungry for expansion in the absence of now defunct competitor Toys R Us and in the wake of increased competition from online retailers such as Amazon.

-

The year to January 2018 saw an increase of 14 stores to The Entertainer’s portfolio. A further 12 stores are planned in the coming year, together with a number of store refurbishments

-

And it’s not just standalone stores fuelling The Entertainer’s expansion. Following a successful trial in 2017, 59 concessions were launched in Matalan stores in September 2018

-

Neither is it solely UK-based; The Entertainer ended the year with 19 international stores trading in four countries, and there are plans to expand into further overseas territories

The year to January 2018 saw The Entertainer post a 38% rise in profits and a 74% rise in total sales across all channels.

Having announced a 30% sales increase on its online platform, The Entertainer relaunched its website in September 2018 to support continued growth. With web sales forecast to triple over the next five years and almost 80% of The Entertainer’s web traffic coming from mobile users, the website has been designed with a mobile-first approach to enhance browsing on tablets and phones. This includes a more refined consumer journey for faster shopping, improved performance to support with increasingly high levels of traffic, and a new predictive search engine for ease when locating products.

Trade for the first half of 2018/19 has been above expectations for The Entertainer and the company is confident about delivering a strong performance for the full 2018/19 financial year.

|

|

|

|

Retail Update - August 2018 |

| |

Posted At: 17 August 2018 00:44 AM

Related Categories: General, Retail, Retailers |

| |

Continuing the pattern of the year, the retail world is still a bit gloomy.

The high street continues to suffer retail losses, as Poundworld closed the last of its stores following administration, and both Henri Lloyd and House of Fraser were rescued in pre-pack administration deals. The eating-out sector hasn’t escaped the dismal picture, as Gaucho Group appointed administrators to its loss-making CAU steakhouse chain, Villandry closed both outlets on the back of soaring rents and Aulds bakery shut up shop in its retail operations to focus on wholesale-only.

However, the prolonged heatwave the UK has been experiencing has had a positive effect in some areas of retail, and there is some better news out there;

• UK consumer spending rose 5% year-on-year in July, boosted by the largest increase in women’s clothing sales since January 2016 amid unusually warm temperatures, according to Barclaycard. The July rise marks the third consecutive month of growth above 5% and the strongest three-month period since it began measuring this data in 2014

• A survey of 1,249 British adults by Kantar TNS has found 16-24 year olds visit department stores more often than older people, despite an overall preference for shopping online - 41% prefer shopping for high street items online, compared to 36% in department stores, and 23% in standalone outlets. Despite this, the majority (82%) of 16-24 year olds have visited a department store in the past six months, the highest of any age category. And 62% believe department stores have a future on the high street

• Over half (55%) of UK consumers now shop more online than in-store compared to last year. Customers now shop online on average six times per month, with Generation Y saying that they buy on a retailers’ websites eight times per month and 27% of men and 25% of women report making an online shopping trip once a week, says eCommerce search and navigation specialists EmpathyBroker that examined current consumers shopping behaviour

• Royal Mail has announced plans to enhance its online shopping delivery experience to include email and SMS notifications after research found that almost two-thirds of customers said it was important to receive updates on the progress of items throughout the delivery journey

• The future of the high street will see retailers become “brand ambassadors” that use emotional intelligence and experiences to connect with consumers, a new study backed by the owners of Centre:MK has found. Hermes Investment Management and AustralianSuper said that by the middle of the next decade shopping centres will be redesigned as providers of “novel and inspiring experiences” rather than simply places to purchase items

• Plastic bag sales in England's supermarkets have dropped by 86% since the government introduced a 5p plastic bag charge in 2015. New figures show that shoppers in England's seven biggest supermarkets bought nearly a quarter fewer plastic bags last year compared to 2016/17 - a decrease of nearly 300 million bags

• New research from Visa has found late-night shopping events are the most popular high street initiative amongst shoppers. Family and community-focused events and seasonal parties such as switching on Christmas lights came in second and third place. Free parking days, farmers markets and food festivals also made it into the top ten, suggesting there is still consumer enthusiasm to interact with their bricks and mortar high street retailers

|

|

|

|

Retail Update - March 2018 |

| |

Posted At: 23 March 2018 16:00 PM

Related Categories: General, Retail, Retail Statistics |

| |

2018 is proving to be a difficult year so far for retail, with not much improvement on the gloomy landscape since our last update and high-profile administrations including Toys R Us, Maplin and Countrywide Stores, and a number of CVAs also approved. The news that over a quarter of the UK’s largest retailers are loss-making does not paint a rosy future.

However, there is some good or interesting news if you look hard enough for it.

• Retail sales showed surprising growth according to the ONS, with retail sales volumes up 1.5%, ahead of predictions

• UK inflation fell to 2.7% in February with a slow-down in food and transport price increases named as the largest downward contributors

• More retailers are jumping on the bandwagon of ‘try-before-you-buy’ for online shoppers

• IGD forecasts that the European grocery retail market is set to achieve sales of €2,289bn by 2022, driven by growth in central and eastern Europe

• Instagram has unveiled its much-anticipated shopping update, allowing UK businesses to sell products via posts

• Research has revealed that consumers are willing to pay up to £1.25 more for a burger if it comes in a gourmet bun, a study by Lantmannen Unibake showed

• The restaurant and bar scenes in Liverpool, Manchester and Leeds are growing at double the rate of that in London

• Pubs continued to prove resilient to industry pressures in February achieving a 1.3% increase in like-for-like sales compared to a 1.5% decline seen in restaurants. However, the Coffer Peach Business Tracker has shown that people continued to dine out in February despite the cold weather and negative media coverage around high-profile casual dining brands closing sites

• Data from online retailer OnBuy shows the North West, West Midlands and Scotland had the highest rate of independent store openings in the UK in 2017 – with 230, 194 and 114 independent openings respectively

• Chinese tourist spend on shopping in the UK has risen by almost a third. Figures from the UK China Visitor Alliance show numbers of Chinese visitors to the UK soared by over 150% in the five years since 2012, from 211,000 visitors to 532,000 in 2017

And finally, a new study has found that Brits have collectively blown £4.46bn on spontaneous purchases while under the influence of alcohol, with almost half of British adults – 45.8% or around 15 million people – confessing to making a purchase while under the influence. Finder’s new report, which surveyed 2000 adults, also revealed that the average spontaneous spend while drunk shopping was a whopping £291.07 each!

|

|

|

|

Retail Spotlight - The turbulence continues for fashion retailers |

| |

Posted At: 21 February 2018 16:43 PM

Related Categories: Retail, Retailers |

| |

Nearly a fifth (19%) of UK clothing retailers are showing “early warning signs” of insolvency, according to accountancy firm Moore Stephens. Out of 35,078 fashion retailers surveyed, 6,580 were showing early signs of financial distress, including a large fall in revenue and poor payment history.

Moore Stephens cited a fall in consumer spending together with growing payroll costs as compounding the pressure on bricks-and-mortar fashion retailers, already struggling to compete with their online pure play counterparts.

High street brands holding their own

FSP’s post-Christmas insights suggest it’s not all doom and gloom on the high street. Certainly brands such as Ted Baker, Joules and Fat Face performed well. These brands share a clear view of who their customer is and focus on driving targeted propositions. In the main, they avoided aggressive discounting; Jigsaw opted to avoid Black Friday and instead look at delighting customers with an innovative collaboration with chocolatier Rococo.

Some of these brands have had to invest in their online position too, closing the gap here.

Young fashion in trouble

It’s really at the younger fashion end of the market where the real trouble lies with New Look well established as the front-runner in a dismal Christmas trading period. CEO Alistair McGeorge is exploring plans to close about 60 of its 600 British stores, as New Look’s like-for-like sales fell by 10.7% in the final quarter of last year.

The media are reporting on vulture funds circling New Look, to capitalise on bond prices plummeting. The collapse had in part been triggered by the fashion brand considering a company voluntary agreement (CVA), with a view to restructure its ailing finances.

New Look’s troubles predate the Christmas period as the retailer has been hit by buying mistakes, over-expansion and competition from rivals like Primark and Zara. This was further compounded by a number of credit insurers declining to cover new shipments by suppliers to its shops. McGeorge is quoted as saying that New Look’s clothes became “too young and edgy” under his predecessor.

Department stores sinking too

New Look joins high street rivals like Debenhams and House of Fraser, which are also battling tough market conditions and ever-increasing competition from online players.

Debenhams, for example, is struggling to find its way out of a cumbersome property estate, keeping stores open it can’t afford to invest in, while tied into leases. At the same time, a confused stable of own brands and lack of online sophistication has left the customer disconnected. House of Fraser too is struggling with its own estate challenges, however it runs the risk of compromising concession partners, who may feel their under-invested stores no longer support their premium needs.

The pressures of rising costs, falling consumer spending and increased competition are set to make the rest of the year challenging for the sector. Innovation and adaptability will be key for those looking to stay afloat.

|

|

|

|

Retail Update - January 2018 |

| |

Posted At: 22 January 2018 10:22 AM

Related Categories: Retail, Retail Statistics, Retailers |

| |

So Christmas has been and gone, delivering a mixed bag of results across the retail sector as evidenced in our Christmas Sales report, and highlighting those retailers that are teetering on the edge.

It’s not all doom and gloom, however.

2017 saw the UK entertainment retail market sales hit record highs in 2017 outpacing the wider UK economy by more than four-fold. According to the latest figures from the Entertainment Retailers Association (ERA), which combines music, film and video games, sales grew 8.8% to £7.24 billion last year, marking the fifth successive year of growth. This “historic” growth is down to the growing presence of digital services like Spotify and Amazon, accounting for more than 70% of entertainment sales values during the year.

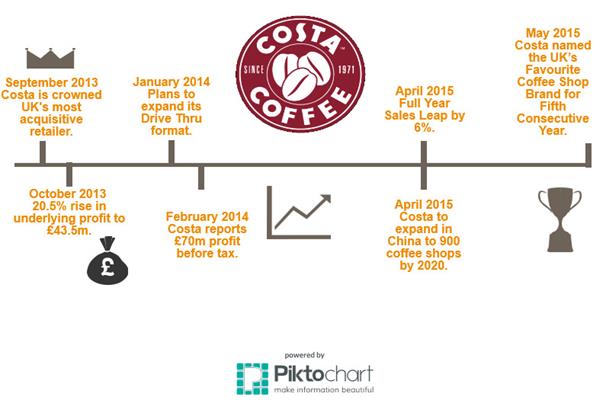

The coffee shop market also had a good 2017. Store openings contributed to 7.3% hike in turnover to £9.6bn across the category in 2018 according to Allegra World Coffee Portal in its Project Café 2018 UK study. Over the year, 1,215 openings took the total number of stores to 24,061. Branded chains accounted for 10.5% of the sales growth, with combined revenue of £4bn. Costa, Starbucks and Caffe Nero continue to dominate the market, and together make up 52.9% of the total branded chain market.

So what does 2018 hold?

With December seeing falling retail sales as a result of Black Friday bringing Christmas sales forward, footfall decreasing during the month and consumer confidence dropping by one point, 2018 could, perhaps, see the retail market get worse before it gets better. Retailers are going to have to innovate and make the latest advances in technology work for them to entice shoppers to part with their cash and visit their shops, rather than shopping solely online; and landlords are going to have to get their tenant mix right to ensure they are catering for the needs of their local shoppers and visitors alike.

FSP can help with location strategies and tenant mix strategies. Contact us to find out how.

|

|

|

|

Retail Spotlight… crikey its Christmas! |

| |

Posted At: 14 December 2017 11:57 AM

Related Categories: Christmas, Retail |

| |

“Its mid-December – how did that happen?” “Better start my Christmas shopping. “ Both phrases we use year in year out with the realisation that Christmas is just around the corner.

Christmas is now firmly in our sights now the madness of Black Friday and Cyber Monday has passed for another year, but something feels different this year. Perhaps it’s the falling retail sales, dropping consumer confidence, and stalling footfall figures or the recent string of administrations and rising online sales contributing to this feeling; perhaps it’s just the snow.

Indeed with Black Friday sales having monumentally shifted online this year, you would be forgiven for thinking that Christmas will follow suit. There are conflicting reports.

More than half (54%) of shoppers do their Christmas shopping online, according a survey of more than 1,500 adults by market research and insights agency Trinity McQueen. Personally, this is where I sit, smugly saying that my festive shopping is now complete.

However, according to a survey of 2000-plus people conducted by mobile network GiffGaff, almost 52% of participants stated they do their Christmas shopping in-store and prefer to shop this way.

There is a definite shift in the way people shop, hunting out the best bargains both on and offline, split by age and gender as to the preference for which method of shopping suits. Indeed, FSP’s research suggests that pure online shoppers are rare; with click & collect and multi-channel shopping making in-store just a part of the jigsaw. The challenge remains to make shopping an experience rather than a chore

What the next few weeks hold for retailers remains to be seen, but FSP will keep you updated with our regular Christmas Sales Reports in January.

|

|

|

|

Retail Spotlight - It’s beginning to look a lot like an Amazon Christmas |

| |

Posted At: 20 November 2017 16:18 PM

Related Categories: Retail, Retailers |

| |

With the unofficial kick-off of the Christmas shopping season due to start on the 24th November, Amazon is, predictably, a step ahead. The retail giant opens its Black Friday Deals Store on November 17 running through to November 26.

Amazon has consistently been building on its position of ownership of Black Friday since the event landed in the UK. It’s also seen as the one to beat, with retailers actively devising their strategies to that end.

Going off-line

This year sees Amazon taking its Christmas strategy in the UK off-line, opening its first pop-up shop, with the aim to drive sales for its 10-day Black Friday event. Based in central London, the pop-up will essentially act as a showroom, where customers can browse Black Friday sales items as well as Amazon Prime offers. Workshops and tutorials will also be offered around its big ticket electrical goods, like Amazon Echoes.

“We’re making Black Friday more fun than ever by holding our first-ever Home of Black Friday pop-up in central London,” Amazon UK country manager Doug Gurr said.

Getting behind the scenes

Leaving no stone unturned, earlier this week, Amazon released a sneak peek of its plans for Black Friday across 30 categories. It’s also revealed a series of behind the scenes photographs of staff at its 16 UK warehouses preparing for what could be its biggest Christmas to date. This is despite the furore around its Christmas advert which implied Father Christmas doesn’t exist which caused an angry viewer response.

A disappointing Black Friday?

So will this be the year Amazon owns Christmas? New figures from Retail Economics suggest that retailers have overestimated consumer appetite for Black Friday this year. While nearly half the retailers surveyed predict a higher Black Friday demand than last year, only 19% of consumers were looking to make the most of Black Friday events, down from 21% last year. FSP, as always, will monitor consumer trends and report back on Black Friday’s place as it becomes further entrenched in the retail calendar.

|

|

|

|

Retail Update - September 2017 |

| |

Posted At: 20 September 2017 15:26 PM

Related Categories: Retail, Retail Statistics, Retailers |

| |

FSP’s SnapShop brings you a snapshot of the UK retail environment for the past month:

-

Young fashion brand Rare London ceased trading in August following the appointment of administrators

-

August retail sales smashed expectations, with overall growth of 1% between July and August according to the ONS – well above the consensus forecast of 0.2%

-

According to the IMRG Capgemini Online Retail Sales Index, UK online sales grew by 16.4% in August. Average basket values were the highest seen in August for five years, reaching £130

-

Latest research by GlobalData predicts that clothing and footwear will drive 35% growth in the UK online market, to reach £69bn by 2022. Mobile spend is also expected to jump 112% in the next five years

-

Second-hand retail is on the rise. According to Ibis World the second-hand market accounts for around 14% of London’s retail establishments, and sales volumes across the industry grew over 5% last year

-

GfK’s Consumer Confidence Index rose two points in August, compared to the July’s one-year low

-

Latest figures from The Department for International Trade reveal that UK fashion exports rose to a record £10.7bn in 2016, with an 8% rise in exports of footwear, clothing and textiles compared with the previous year. The US, Hong Kong and Australia in particular snapped up more than £1bn in UK exports

|

|

|

|

Retail Update - August 2017 |

| |

Posted At: 18 August 2017 00:33 AM

Related Categories: Retail, Retail Statistics, Retailers |

| |

FSP’s SnapShop brings you a snapshot of the UK retail environment for the past month:

-

July saw the demise of Chicago Rib Shack after it struggled with a lack of working capital; the chain was subsequently rescued by the entrepreneur behind the Camden Dining Group

-

The month also saw the weakest reading in consumer confidence since just after the Brexit vote, dropping two points to reach -12 in GfK’s Consumer Confidence Index. Excluding the post-referendum dip in July 2016, the index hasn’t been this low since 2013

-

Online retail sales grew by 11% in July, representing the slowest growth for the month since July 2013 according to the latest IMRG Capgemini e-Retail Sales Index. So far in 2017, online sales have grown by 12%

-

British Land research has revealed a symbiotic relationship between physical stores and ecommerce. The research, using data from Connexity Hitwise, shows that when a new store opens, traffic to the retailer’s website from the surrounding postal area increases by 52% on average within six weeks of opening. And digital traffic from the local area then remains around this level, demonstrating that a physical store has a significant, positive and sustained impact on digital interaction with the brand

-

The UK sports clothing market is expected to climb 8% to £2.5bn this year according to GlobalData, as the athleisure trend continues to grow. Customer demand following 'high profile attention via Instagram influencers' has driven fashion retailer investment in sportswear

-

UK consumers made nearly 1.4 billion card payments in June, an increase of 12% on the same month last year and the highest growth rate since 2008, according to new figures from UK Finance. Contactless payments accounted for 34% of all card transactions, while online payments made up 13%. There are calls to increase the spending limit on contactless cards

-

The KPMG/Ipsos Retail Think Tank said that the health of Britain’s retail industry had fallen in the second quarter and was likely to drop even further in the third quarter. It said that if this were to happen, it would represent three consecutive quarters of negative performance “which is something that has not happened since 2012”

|

|

|

|

Retail Update - July 2017 |

| |

Posted At: 25 July 2017 14:42 PM

Related Categories: Retail, Retail Statistics |

| |

The past month on the high street has seen Handmade Burger Company fall into administration and close nine of its stores, and, not surprisingly, Store Twenty One collapse into liquidation, with the subsequent closure of its remaining 122 shops.

Retail sales in June have driven a “renewed sense of optimism” for the UK economy, showing promising recovery from last month’s four-year low. The latest figures from the Office for National Statistics (ONS) revealed that sales volumes jumped 1.5% in the three months to June, rising significantly from the 1.4% drop seen in the prior quarter.

Couple this with a prediction from Worldpay that overseas visitors could spend as much as £2.4bn in a spending bonanza by the end of this summer as they take advantage of sterling’s weakness, and all is not looking too gloomy on the high street.

According to CBRE’s bi-annual Global Prime Retail Rents report, New Bond Street has been revealed as the second most expensive retail location in the world, seeing a huge 39.1% increase in prime rental growth in the first quarter compared to the same period last year to give it an average annual rent of £1345 per sq. ft. New York retained its top spot, with Fifth Avenue almost doubling the sq. ft. value of New Bond Street with an average of £2487.52.

An interesting report, Retail Revolutions: The Rise of the Community Shopping Centre, has revealed that an increasing consumer focus on affordability and convenience has seen value and discount retailers increase their UK store count by more than 5000 since 2009. Value retail accounted for 87% of all store growth in the UK during that time. The report also said supermarket chains have increased their convenience offer with more than 1600 stores since 2009.

The online market continues on its steady march. According to new research from GlobalData, clothing and footwear is driving smartphone shopping in the UK – with the sector set to account for 42% of all smartphone spend by 2022. Its latest report says spend via smartphones will outperform spend via tablets to account for 51.5% of the UK mobile and tablet market in 2018 – and is set to grow 112% in the next five years. Key sectors aiding market acceleration via smartphone are clothing and footwear, which have the highest proportion of sales on these devices. However, food and grocery is expected to be the fastest growing sector in terms of sales via smartphone to 2022.

It will be interesting to see how the smartphone shopping trend continues and if this becomes the ‘new’ face of online shopping, as well as how the high street fares over the summer months. FSP aims to keep you up-to-date with all the latest news and trends.

|

|

|

|

Retailer Spotlight - Amazon continues on its disruptive path |

| |

Posted At: 12 July 2017 13:00 PM

Related Categories: Future of Retailing, Retail, Retailers |

| |

In this month’s FSP Spotlight, we’re looking at how Amazon remains on track to leave no corner of the retail space untouched by its disruptive strategy.

Disrupting a new industry

First, let’s look at its acquisition of Wholefoods, a move that took many industry commentators by surprise; not only is it a tech company taking over a grocery chain, but because Amazon has a reputation for making smaller deals. This $13.7bn deal is Amazon’s first ever $1bn+ purchase. The acquisition seals Amazon’s long-term commitment to building out its grocery business, consolidating its efforts via Amazon Fresh and the introduction of brick-and-mortar stores.

Amazon’s expertise in distribution means both grocery delivery and "Click and Collect" is set to sky-rocket though experts do expect in-store innovations, such as live cooking shows, trend showrooms and personalisation. At the same time, while Amazon has kept its UK-ventures small-scale, experimental and mostly confined to London, further disruption of the UK supermarket sector – and “Amazon fear” is widely expected.

Real-world expansion

Close to Amazon’s strategy is how it uses Whole Foods stores to keep expanding its own successful third-party business, an area that generates significantly higher margins than items sold directly by Amazon. It’s anticipated that the deal will build on its bricks and mortar strategy, utilising the Whole Foods locations as local distribution points for food as well as other items, as well as capitalising on Whole Foods' organic private label brand.

The launch – albeit small scale – of real stores earlier this year has also strengthened the brand’s footprint. While bricks and mortar retail remains a marginal part of Amazon's business, benefits include boosting brand awareness and exposing customers to Amazon's Prime subscription service. Prime members get the online prices in the store, while non-members pay the list price for books.

Becoming “the best place to buy fashion online”

Fashion also remains a huge focus for Amazon and this year it seems closer to achieving its aim of being the “best place to buy fashion online”. So far in 2017, it has launched seven private label apparel brands, added its own lingerie line with cut-rate prices and announced an extension of its Alexa-enabled Echo product line specifically designed to take outfit photos and give style feedback. The company is also investing in its own fully automated clothing factory, a shipping company and physical stores, showing it means all-out war on the industry.

Shares of Amazon have gained 9.2% in the past three months, compared with the S&P 500 index gain of 3%.

So what’s next for Amazon? Having filed patents for a robotic fashion mannequin that can change dimensions to allow a shopper to see how clothing items fit on different sizes, and a ‘try before you buy’ services in the US, it is clear that Amazon has the potential to become a major player in the fashion market, and that in the long-run this could have an impact on traditional fashion retailers. Watch this space!

|

|

|

|

Retail Update - June 2017 |

| |

Posted At: 16 June 2017 11:39 AM

Related Categories: Administrations, Retail, Retail Statistics, Retailers |

| |

May was a month of change on the high street. German womenswear brand Basler fell into administration; Joy was bought out of administration by its owners in a pre-pack deal; and Edinburgh Woollen Mill acquired the Jaeger name. Additionally, Edinburgh Woollen Mill embarked on a new department store concept, Days, which launched in a former BHS store in Carmarthen.

Household spending growth slowed in May as British shoppers selectively cut back purchases, as the rise of inflation threatens living standards. According to Barclaycard figures, spending was up 2.8% on the year, which marked the slowest rate of growth since last July. The British Retail Consortium’s (BRC) study of shops’ sales found growth slowed to 0.2% on the year, a substantial slowdown from the strong Easter spending in April.

The BRC’s Online Retail Sales Monitor also found that e-commerce sales grew at their slowest rate for more than four years in May. Online sales of non-food products grew by 4.3% in May – down from 13.7% a year earlier and at its lowest level since the BRC analysis started in December 2012. The three-month average stands at 7% – also the lowest the BRC report has yet recorded.

This slow-down both online and on the high street in May could have been the result of a pre-election and pre-Brexit blip. However, according to the long-running and closely-watched GfK Consumer Confidence Index, consumers’ confidence in May stood at -5, two points up compared to -7 in April, suggesting that this isn’t the case.

Interestingly, Payments UK – the trade association for the payments industry – has forecast that debit cards will overtake cash as Britain’s most frequently used method of payment by 2018 thanks to the rise in contactless cards. Worldpay, which handles 40% of all UK card transactions, said that spending on all forms of contactless systems now accounts for 28% of all non-cash transactions in the UK, with total spend exceeding £10b for the year in 2016.

However, the Bank of England’s chief cashier and director of notes has said cash payments were “very much alive and kicking” and that contactless and electronic payments were not a threat. Victoria Cleland highlighted how technology has had a “huge impact”, with ways to pay including digital currencies, mobile payments and innovations such as contactless cards gaining “real traction”. But contrary to predictions of the eventual death of cash, Cleland said “if we dig further, it is clear that cash is very much alive and kicking”.

|

|

|

|

Retail Update - April 2017 |

| |

Posted At: 26 April 2017 10:20 AM

Related Categories: Administrations, Retail, Retailers |

| |

March saw three high profile retailers hit the buffers:

-

Agent Provocateur – subsequently bought by Four Marketing through a pre-pack deal

-

Brantano

-

Jones Bootmaker – the majority of its business was subsequently sold to private equity Endless, which acquired 72 stores as part of the deal

According to insolvency firm Begbie Traynor, almost 23,000 retailers reported significant financial stress in the first three months of 2017 as cost pressures continue to mount. Further administrations have been predicted by the firm, which has reported a 4% rise in retailers under financial strain compared to the same period last year.

The ramifications of the business rates reforms, announced last month, have yet to be fully felt in the industry. Mixed with increased price competition, a weak pound, dwindling consumer spending and a rise in minimum wages, analysts expect a 'large number' of retailers to fail in the coming months.

However, it is not all doom and gloom on the high street.

A record number of overseas tourists travelled to Britain during the first two months of 2017, up 6% on the same period last year, according to new figures published by VisitBritain. The 5.2 million visits also resulted in a record spend of £2.7b in January and February, a year-on-year increase of 11%.

London’s luxury market was also boosted by a momentous return of Russian visitors and Americans’ surge in interest for British luxury in the first quarter of the year. International tax free shopping data for London Luxury Quarter, which covers Mayfair, St James’s and Piccadilly, showed growth of 39% in the period. In addition, Russian visitors’ tax free shopping spend rose by 88% in March while American spend grew by 116% year-on-year.

Online continues on its steady upward trajectory, with UK shoppers spending £1bn a week online in March - 19.5% more than they did in the same month last year. That total accounts for 15.5% of all retail spending, excluding fuel, during the month, and contrasts with 13.6% a year ago, according to the Office for National Statistics’ Retail Sales report for March 2017. However, consumers are getting harder to please when it comes to online shopping (see FSP View).

It will be interesting to see what the next few months have in store for retail and consumers, as we head towards a general election. Whatever happens, SnapShop will keep you up to date with the latest news.

|

|

|

|

Retail Update - March 2017 |

| |

Posted At: 24 March 2017 15:51 PM

Related Categories: Future of Retailing, Retail |

| |

February saw restaurant group Viva Brazil fall into administration after unsuccessful expansions put the business under unsustainable financial pressure. The business was sold as part of a pre-pack deal to its founder and has kept its restaurants open in Liverpool, Glasgow, Cardiff and Birmingham.

The month also saw a for sale sign hoisted above Jones Bootmaker, with all options for the business being explored. At the time of writing, the future of Jones Bootmaker hangs in the balance as it teeters on the brink of administration.

As ever, speculation surrounding Brexit and business rates dominated the headlines. A new study by Total Retail revealed that a fifth of UK shoppers (20%) think Brexit will impact their shopping habits over the next 12 months, with almost six in 10 consumers worried about their lack of disposable income; and almost one-fifth of small businesses - including retailers - would consider closing down as a result of the looming business rates revaluation, according to research from the Federation of Small Businesses. The research suggests that 36% of small businesses expect to see their rates increase, with 44% expecting bills to eventually rise by more than £1000 a year. Of the businesses expecting a rise in rates, 54% expect profits to drop and 38% said they will increase prices to make up for the loss.

However, it was not all doom and gloom on the high street.

According to Savills’ Global Luxury Retail report, London topped the global rankings for new luxury retail store openings in 2016. London saw a total of 41 new luxury openings during the year, (of which 15 were the respective brand’s first ever store in London), compared to 36 in Paris and 31 in both New York and Dubai.

New figures from Visa UK’s Consumer Spending Index show that average spend grew 1.5% in February, up from a five-month low of 0.4% in January. Spend on recreation and culture saw the most significant boost of 3.3%, compared to a rise of just 2% on miscellaneous goods and a drop in spend on clothing, footwear, food, drink and household goods.

It will certainly be interesting to see how consumer spending fares over the next few months and the impact rising business rates has on business. SnapShop will aim to keep you informed of this as and when it happens.

|

|

|

|

Retailer Spotlight - Troubling Times for Womenswear |

| |

Posted At: 16 March 2017 14:17 PM

Related Categories: Retail, Retailers, Womenswear Retailer |

| |

Style Group Brands, the parent company of labels such as Jacques Vert, Windsmoor, Eastex and Precis, has launched ambitious plans to get the business back on track. The review, led by new chief executive Shaun Wills, includes the appointment of KPMG to explore a sale or restructuring options for the group. The UK’s largest womenswear concession operator is the latest fashion retailer to be affected by toughening trading conditions and increasing competition on the high street. Just this week, shareholders at French Connection have called for a break-up of the retailer as they record a full-year loss for the fifth consecutive year.

Style Group Brands was formed via the merger of Jacques Vert and Irisa Group, and trades in department stores including Debenhams, House of Fraser and John Lewis's online operation. It currently operates from more than 1,850 outlets in 470 separate locations in the UK, Europe and Canada.

The potential sale or restructure could lead to a reduction in the number of outlets, possibly under a new owner. It follows a wave of auctions of women's fashion brands. Last December, Aurora Fashion Group announced it was putting its brands Oasis, Warehouse and Coast up for sale. Elsewhere, Jaeger has appointed advisers to handle an auction and shareholders in LK Bennett are expected to follow suit in the near future.

While the Style Group Brands saw sales increase by 4% on a like-for-like basis for the second half ended 31 January, the group is very much at the starting point of its turnaround strategy.. Shaun Wills commented, “The real test is this spring/summer, which is where all our work around more commercial product will start to be seen,”

Wills, who took over as CEO from Tim Davies in April, suggested that there is some reorganisation going on in stores in terms of store management staff however no other details have been shared.

Clothing retailers are facing intense pressure from the impact of inflation, which is set to lead to substantial price hikes. Other costs linked to business rates, the national living wage and apprenticeship levy also pose a real challenge for the sector.

|

|

|

|

Retail Update - February 2017 |

| |

Posted At: 22 February 2017 14:42 PM

Related Categories: General, Retail |

| |

January certainly proved to be a mixed month to mark the start of 2017, with a mixed bag of Christmas sales being reported across the board, and both retail sales and footfall dipping, even online sales faltered this month. Although not surprising, with Christmas being the monthly comparative, it is perhaps a sign that consumers are now starting to worry about what this year may bring; Brexit, business rate fears, price rises etc.

All is not doom and gloom however, with confidence increasing from -8 to -5 percentage points between Q3 and Q4 2016 among the 18 to 34-year-old age group resulting in them spending more money in bars and restaurants according to Deloitte.

The Leisure Consumer Q4 2016 update confirms earlier research from Deloitte which found that confidence about disposable income, debt and job security among millennials is now at a six-year high.

However, when looking forward to the first quarter of 2017, the research found that this age group is expected to spend less on eating and drinking, and more on holidays and gum activities than they did in Q4 2016. It will be interesting to see if this is the case, or if the increasing trend of eating and drinking out continues.

The start of the year also saw the price of an average basket of grocery items fall by 3% compared to January 2016. According to mySupermarket’s monthly Groceries Tracker, the price of a basket of 35 popular items came to £82.27 compared to £83.33 for December. This can only be good news for shoppers when price rises are imminent elsewhere.

With sales via smartphones set to more than treble in value from £13.5bn to £43bn over the next four years according to research by Google, PayPal UK and OC&C, and its increasing impact on people’s lives, a study by Apadmi has found that nearly 30% of consumers would like to see more innovation in mobile apps to enable the technology to provide a more personalised shopping experience. The study found that shoppers would be more likely to download a retail app if it featured technology that helped them to make a buying decision, or let them preview products before purchasing them, something for retailers to consider going forwards into an increasingly digital market.

SnapShop itself has only recorded one administration this month, that of Moda in Pelle, which was subsequently rescued by its founder through a pre-pack deal. Looking ahead, a number of new retailers are looking to enter the UK market this year, including H&M’s Weekday fascia, Polish retailer Reserved, and Swiss phone repairer iKlinik.

|

|

|

|

FSP View: Will F&B Remain the Great Retail Saviour? |

| |

Posted At: 22 February 2017 14:20 PM

Related Categories: Retail, Retailers, Town & Shopping Centre Management |

| |

Here at FSP, whilst on balance being highly positive about the future for F&B in retail environments, we are cautious about some of the signals that it’s impossible to ignore.

Just looking back at December 2016 for a moment the positive contribution made by the ‘experience’ sector at that time of year is clear. Visa, through their IHS Markit report, reported a 2.6% LFL increase in consumer spending overall but +7.3% in hotels, restaurants and bars and +6.4% in recreation and culture. By comparison clothing and footwear was down -0.7% and household goods -1.1% on a like for like basis. January’17 seems to have got off to a good start with the same group citing hotels, restaurants and bars up 6%. Some interesting numbers also came out of Deloitte in their Leisure Consumer Update in which they highlight increased spending in cafes, bars and restaurants amongst 18-34s from Q3>Q4 2016 compared to 35-54s and 55+. So far so good – there is little doubt that F&B has provided huge opportunities for retail property owners throughout the last 5 years (and probably since the start of the recession) to inject life and vibrancy into shopping centres/parks and outlet malls, evidenced by the realisable rents in this sector.

On the potential downside we all know that there is far more retail space than actually required in the UK and there are concerns that over-supply in the F&B sector might be storing up similar problems: sales density dilution, declining profitability and potential closures. This is particularly the case in the London market but where the metropolis leads other large cities and towns follow. A phenomenon of retailing generally accepted is that product life brand cycles are shortening with the need for constant innovation crucial to the maintenance of shopper interest. Our view is that this is particularly the case in F&B where new brands, menu variations and service techniques continue to proliferate. Staying with a concept too long can lead to problems; for example The Restaurant Group (TRG) reported a drop of 5.9% in Q4 2016 LFL sales plus the closure of 37 restaurants (though in the same period 24 had opened) as well as putting a further 23 sites up for sale and the need for ‘substantial price and proposition changes’. TRG is clearly reacting positively to make the necessary changes but this approach came too late for Ed’s Easy Diner which went into administration in October 2016 and Red Hot World Buffet in June 2016. On the positive side the latter managed to continue trading and Giraffe Concepts took over 33 Ed’s Diners. Quoting the National Living Wage and potential price increases as a result of weakness in sterling many large F&B groups have sounded the warning bells for 2017 though the extent to which these will be realised is, as yet, unclear. Although inflationary pressures are mounting the feed-through into shop prices is yet to manifest itself. Early days perhaps but the BRC Nielsen Shop Price Index for January’17 v ’16 shows non-food prices dropping -2.3%, no doubt due to high seasonal markdowns after a relatively poor trading season but contributing to a continuation of that all-important consumer confidence mentioned earlier.

FSP has recently placed more resource behind its own F&B services with the recruitment of a specialist consultant – Harri Jaaskelainen – and the development of a comprehensive set of new tools to evaluate F&B trading potential and solutions in any retail environment. The trend for increase in ‘Fast Casual’ dining (think Tortilla, Itsu, Nando’s, Tapas Revolution) where seat turn is faster than standard Casual Dining and ATV higher than Fast Food is coming through clearly in analysis of shopper trends when comparing the scale of existing sales versus potential. What is increasingly evident is the need for a careful evaluation of the trading opportunity and identification of F&B gaps based on the shopper profile, demographic content and competitivity of each individual location rather than a simple assumption that piling in more F&B is the universal panacea.

To find out more about FSP’s F&B approach please call Harri on 01494 474740 or email Harri@fspretail.com

|

|

|

|

Retailer Spotlight - Aldi steps ahead as UK’s fifth largest supermarket |

| |

Posted At: 14 February 2017 16:15 PM

Related Categories: Retail, Retailers |

| |

Aldi, the German-owned supermarket, has overtaken the Co-op to become the UK’s fifth largest supermarket. New figures from Kantar Worldwide show that a 12.4% year-on-year sales rise has taken Aldi’s market share to 6.2%, ahead of the Co-op's 6%. FSP previously reported on Aldi taking over from Waitrose as the country’s sixth largest supermarket just under two years ago. It is Aldi’s latest growth milestone; a decade ago, it was the UK’s 10th largest food retailer, accounting for less than 2% of the grocery market.

The move follows an ambitious programme of store openings – 70 stores in the last year- and attracting 826,000 more shoppers than the same period last year. The group plans to open a further 70 new stores this year in response to customer demand. The figures highlight the challenges faced by the big players from discounters like Aldi and its rival Lidl. Despite a slower pace of growth in the past three years, Aldi and Lidl now share nearly 11% of the entire UK grocery market, while Tesco, Sainsbury’s and Asda continue to lose ground.

Much of Aldi’s success has come down to its simple proposition, aimed to save customers time as well as money, and centred on a much smaller range of goods than rival stores. The simplified approach has shifted how the big four supermarkets operate, as they move away from multi-buys and discounting. Traditional counterparts are responding instead with everyday low pricing and a simpler proposition as they try to win shoppers back.

Aldi UK’s chief executive, Matthew Barnes, attributed the supermarket’s success to its “unique offering resonating with British shoppers.” He said: “Aldi customers get products of comparable quality to the leading brands at prices that are significantly cheaper than any of our competitors.”

Looking at the big four supermarkets, Morrisons was the only one to gain market share in the same period, growing to 10.9%, primarily due to the success of its premium own label. With 28% of the UK market share, Tesco remains the market leader in the UK.

Aldi has also announced plans to invest and extra $1.6 billion to upgrade its 1,300 U.S. stores.

|

|

|

|

Retailer Spotlight: Corks pop as Majestic enjoys Christmas sales boost |

| |

Posted At: 23 January 2017 17:10 PM

Related Categories: Retail, Retailers |

| |

A combination of the “year of gin” and soaring sparkling wine sales have helped Majestic Wine celebrate its best Christmas to date. For a business that draws nearly a third of annual sales in the Christmas period, a strong festive season is critical. The boost is welcome news for the retailer, which issued a profit warning in September following a failed US marketing campaign and poor business customer performance.

Majestic’s gin sales rose 55% on last year, with upmarket brands such as Warner Edwards rhubarb gin and Sipsmith sloe gin performing particularly well. 2016 saw national gin sales break the £1bn mark for the first time. Sparkling wine sales rose 12%; prosecco sales increased three times faster than champagne.

Majestic, which acquired online retailer Naked Wines in 2015, reported sales at established Majestic Wine stores being up 7.5% in the 10 weeks to 2 January. With a sales increase of nearly 30% at Naked and 62.3% at fine wine specialist Lay & Wheeler, the overall group’s sales rose 12.4%.

This year’s performance can partly be attributed to a 1% cut in gross profit margins against last year, as the company moved to compete more effectively with the UK’s heavily discounted market. Aldi and Lidl have both made heavy gains in alcohol retail recently. Value-for-money drinks offers, voucher marketing and free standard delivery for just six bottles has proven successful for Majestic. The retailer’s three-year transformation plan has also helped it stay on track to generate £500m in annual sales by 2019.

Part of Majestic’s transformation programme is a complete re-focus on customer service and shopper loyalty. Earlier this month, Majestic appointed a new chief customer officer as Joshua Lincoln moved across from Naked Wines. Improved availability, enhancing the range, putting more staff on the shop floor and rolling out next-day home delivery will play a part in this refreshed customer strategy.

Looking at 2017, Majestic predicts Portuguese wines will be ‘the next British favourite’, after sales rose 160% over Christmas, overtaking Rioja as the retailer’s best-selling red wine.

|

|

|

|

Retail Update - December 2016 |

| |

Posted At: 16 December 2016 12:40 PM

Related Categories: Administrations, Retail, Retailers |

| |

As we rapidly head towards the end of 2016, it has been pleasing to see that no administrations have been recorded on SnapShop since our last update.

November was the month for Black Friday – see our previous blogs – and the start of discounting as retailers geared up to capture the all-important Christmas spend. In fact, recent research from Deloitte has found that for the sixth consecutive year, consumers are enjoying bigger pre-Christmas discounts than they did in the previous year. Analysis of over 300,000 products currently for sale in the UK reveals that discounts are currently averaging 43.3% - some 1.5% deeper than at the same time last year.

Despite all the discounting, retail footfall in November edged down 1% on the same month last year following a 0.9% drop in October, and retail sales only edged up 0.6% year-on-year. and GfK’s Consumer Confidence Index dropped 5 points to -8. As has been seen throughout the year, the leisure industry has remained resilient and November was no different - like-for-like sales in managed pub and restaurants grew by 1.1% against 2015, with London providing the biggest increase.

London has been a talking point as it remains an attractive destination for new UK retail entrants. According to new research from CBRE, over 75 new retail entrants opened in London in 2016, with the prime streets in Mayfair and Chelsea proving to be a magnet for luxury brands.

Interestingly, a new report has predicted that travel hubs will be the most favoured location for new stores in the coming year. (0912) This doesn’t come as much of a surprise to FSP, when new figures have shown that like-for-like retail sales at Network Rail managed stations grew by 3.5% from July to September. This equates to total sales of over £166 million, up from £160 million in the same period last year.

What remains to be seen is how retail will fare for the remainder of the year and who will be the winners and losers over the festive season. SnapShop will bring you all the news on this in January.

In the meantime, we wish you all a very Merry Christmas and a Happy New Year

|

|

|

|

Retail Update - November 2016 |

| |

Posted At: 18 November 2016 00:29 AM

Related Categories: Administrations, Retail, Retailers |

| |

Since our last update, SnapShop has recorded three administrations:

-

Betta Living appointed administrators as rising rents pushed the company into a loss, and put pressure on cash flow

-

American Apparel in the UK called in administrators from KPMG. The failure of two American Apparel UK companies, American Apparel (UK) Ltd and American Apparel (Carnaby) Ltd comes as the US company is being sold. The UK operation, along with some European parts of the business, is not part of the sale

-

Bakery chain Cooplands collapsed into administration after its CVA failed, and was subsequently acquired by Cooplands Retail Limited, formerly associated with the same directors as Alison's Coffee Shop, which had traded as Cooplands since its initial administration last year

Despite what some would see as doom and gloom on the high street in terms of the rise in administrations reported over the past two months, and the news that Gap’s Banana Republic fascia is exiting its store presence in the UK, October’s retail sales grew at their highest rate since April 2002. Coupled with strong online growth throughout the month and backed up with GfK’s Consumer Confidence Index, the trend for buying now seems set to continue as we head towards Black Friday and Christmas.

Indeed, with many retailers now having launched their festive campaigns to entice shoppers and the grocers heading into battle over toy price matching schemes, it will be interesting to see if the big four can reclaim some lost ground over the discounters as we head towards the end of the year.

In other high street news:

With the crazy Christmas season upon us, FSP will be monitoring the news closely to see who is making a success of the latest retail evolutions.

|

|

|

|

The Entertainer - let me Entertainer you |

| |

Posted At: 08 November 2016 00:48 AM

Related Categories: Retail, Retailers |

| |

On track to expand both its national and international footprint, this month’s Spotlight looks at The Entertainer. With soaring online sales underpinning UK and international expansion, the toy specialist recently posted its seventh consecutive year of growth.

The Entertainer was originally founded by husband and wife team Gary and Catherine Grant in 1981. In recent years, it has experienced significant growth, optimising multichannel opportunities, and using online and mobile channels as a way to drive greater engagement, in-store sales and brand loyalty. Sales at its online site, TheToyShop.com, climbed 39%, due in no small part to its 30 minute click and collect service.

The retailer now has 127 outlets in the UK and recently announced it is opening its first European stores in Cyprus through a franchise partnership. The Entertainer has four stores in Pakistan and two in Azerbaijan, and aims to open standalone stores in Cyprus during 2017.

Much of The Entertainer’s success can be attributed to its commitment to innovation and an ability to respond to changing consumer demands, embracing the need for experiential marketing and personalised customer experiences.

Brand licensing has also been a vital part of the business’ long-term strategy and where The Entertainer has developed a point of difference. Profits spiked in 2014/15 thanks to the likes of Loom bands, LEGOmovie and Frozen. Recent collaborations include its 26-strong range of Nickelodeon licensed products, with craft sets, science kits and a magic box. This range was stocked exclusively, and supported by joint marketing campaigns by both parties.

Its "Super Saturdays" concept has also been hugely successful. Working with licensors and suppliers, these themed 360-degree marketing campaigns include TV, window takeovers, online, social, feature space in-store, competitions and product demonstrations. The aim is to bring their ‘best in class’ proposition to life in-store and drive interaction and engagement with customers. Disney Princess Super Saturdays resulted in a 20% brand market share.

The Entertainer has set itself apart through its charitable giving too, and practises tithing, donating 10% of its net profit to charity - this year it gave away £750,000.

Looking ahead, there have been some challenges. A recent investment of £1.2m in a new UK warehouse impacted the business’ recent results. Gary Grant has also been vocal about the impact of Brexit, warning retail prices will rise 10% as a result.

However, with a commitment to innovation and working in partnership with brands to create exciting new customer-led concepts, FSP expects this retailer to continue to delight children – with sales to support it.

|

|

|

|

Retail Update - October 2016 |

| |

Posted At: 20 October 2016 16:45 PM

Related Categories: Administrations, Retail, Retailer At Risk, Retailers |

| |

Since our last update, bakery and catering company Peyton and Byrne has gone into administration following the loss of contracts at London’s Kew Gardens and the British Library. The bakery business has been sold as a separate entity to Peyton and Byrne Bakeries Limited, a new business owned by the Peyton family, and its five existing public catering contracts have been sold as part of a pre-packaged sale to foodservice company Sodexo.

As seen in August, September has painted an equally rosy picture on the high street:

-

Data from IMRG Capgemini’s eRetail Sales Index shows that September’s online performance topped off a strong quarter, with the Index recording the highest quarterly growth at 17% since the first quarter of 2014

-

According to the latest Coffer Peach Business Tracker, consumer spending on eating and drinking out continues to hold up post-Brexit, with managed pub and restaurant groups reporting collective like-for-like sales up 1.8% in September against the same month last year, with those outside the M25 reporting bigger increases than those in the capital

-

Consumer confidence rebounded to pre-Brexit levels in September, with GfK’s long-running Consumer Confidence Index increasing by six points this month to -1 (30/09)

In other news from the high street:

-

The UK stationery market is set to rise by 2.4% to around £2.1 billion by 2021 according to research from Verdict Retail

-

Consumer confidence rebounded to pre-Brexit levels in September, with GfK’s long-running Consumer Confidence Index increasing by six points this month to -1

-

The post-Brexit crash in the value of the pound means that the UK is now the cheapest market in the world for luxury goods according to research from Deloitte

And finally, Mintel predicts UK Christmas sales will rise 2.5% to £42.2bn this year but this depends on retailers’ approach to the all-important Black Friday. It will be interesting to see the strategies surrounding what has become one of the most important festive shopping dates on the calendar, something we at SnapShop, will keep you up-to-date with.

|

|

|

|

Retailer Spotlight - The Works |

| |

Posted At: 15 September 2016 16:00 PM

Related Categories: Retail, Retailers |

| |

With the news that The Works has delivered the most profitable year in its history, FSP takes a look back at the strategies that have driven its growth over the years.

Founded in 1981, The Works is a leading retailer of discount books, toys, gifts, stationery and arts & crafts, and operates from over 300 stores in high street and factory outlet locations. Despite its track record of profitability, it suffered deterioration in trading in 2007 and was placed into administration in January 2008.

Following its administration and subsequent sale to Endless, The Works embarked on a turnaround plan which included a refocus on improving its product offering, growing store numbers and modernising its store portfolio, as well as strengthening its management team.

These changes paid dividends, as The Works went on to record an improving EBITDA and sales performance year after year. And following the revamp of its website and its best ever Christmas sales in fiscal year 2012, the business was ranked number 7 in the Sunday Times Fast Track 2012 Buyout Track 100, and was ranked number 1 in the Midlands.

In 2013, The Works pioneered a loyalty scheme ‘Together’ across its entire store portfolio, in what was described as a first for the value sector. This scheme has been hailed a success, now boasting over 75,000 members and seen as an important factor in driving growth at the retailer.

It all seems to be going in the right direction for The Works, who for the 53 weeks ended May 1 2016, reported EBITDA of £12.7m from £9.5m in 2015 – a 37% increase year on year. The company grew sales to £154.4m from £117.2m the year before. This was a 9% growth on the previous year, which it attributed to a strong performance in key product categories, the addition of 40 new stores, and the continued growth of the online business which saw The Works develop a click and collect proposition.

The coming year will see The Works open at least 50 stores, with the company stating that the “fundamental principles” that have driven the strong profit growth over the last three years, such as proactive management of its property portfolio with zero loss making stores, strong cost controls and simple operating processes, remaining “cornerstones” of the business going forward.

It will be interesting to see how The Works continues to adapt to an ever-changing retail landscape in order to remain competitive, but for now it certainly seems to have got it right.

|

|

|

|

Retail Update - August 2016 |

| |

Posted At: 18 August 2016 13:51 PM

Related Categories: Retail |

| |

So despite the widespread panic that ensued directly after Britain voted to leave the EU, it has not been all doom and gloom in the retail world. Shopping centres are still being bought and sold, retailers are still expanding their store presence, and consumers are still spending money, in a sure sign that the world hasn’t just stopped but is continuing as it has always done.

Britain’s managed pub and restaurant groups saw collective like-for-like sales grow 0.3% in July against the same month last year, indicating that the country is not giving up on going out to eat and drink in the wake of the Brexit vote. Figures from the Coffer Peach Business Tracker show that London operators recorded a healthy 2.9% like-for-like sales uplift against July 2015, while those outside the M25 saw like-for-likes fall 0.5%.

But it’s not just on leisure that consumers are spending. Online fashion sales jumped 22% in July according to the IMRG Capgemini e-Retail Sales Index, indicating that spending habits are not being reined in but that consumers are utilising their disposable incomes which are at a record high. As highlighted by the ONS, the median household earned £26,400 after taxes and benefits in the year to 31 March, up £700 on the previous year, and £400 above the previous high of £26,000 in 2007-08.

International retailers still see the UK as an essential launch pad into Europe and are signing for stores, and there has even been a revival into the use of UK manufacturers. John Lewis is launching a new 'Locally Made' initiative, bringing together locally designed and made products from across the country in a dedicated area in its shops, and Marks & Spencer has become one of the first customers of a new cotton mill in Greater Manchester, which is set to be fully operational from autumn.

And with new retail and leisure developments being given the green light to proceed, and the initial stages of the Night Tube being launched this week, retail is set to be boosted even further both in the Capital and throughout the UK.

Although Brexit will undoubtedly have an impact in the future, there certainly seems to be no signs of it stopping us yet.

|

|

|

|

Retailer Spotlight - Mothercare |

| |

Posted At: 25 July 2016 00:26 AM

Related Categories: Retail, Retailers |

| |

Nursery retailer Mothercare is making steady progress on its turnaround plans, having reported its first statutory profit in five years in its latest financial year to March 2016. Although its latest quarterly results show a slight decline in sales, Mothercare said that fall reflected a 4.8% year-on-year reduction in space, as it continued to rationalise its UK store portfolio.

Having embarked on its turnaround strategy in 2014 which involved new chief executive, Mark Newton-Jones, over-seeing a six-point recovery plan that included a focus on digital and recapturing gross margin, Mothercare moved away from heavy discounting and turned its attention to restructuring its store portfolio and online operations to compete in the digital age.

Since 2014, Mothercare has rationalised its UK store portfolio, reducing from 220 UK stores in fiscal 2014 to 189 in fiscal 2015, and now to 170 in the year to March 2016. This figure includes eight Early Learning Centre stores.

While Mothercare has been busy closing under-performing stores in the UK, it has expanded its international footprint, rising from 1,221 international stores in fiscal 2014 to 1,273 stores in fiscal 2015, ending its current quarter with 1,322 stores. Of those, 958 were Mothercare stores while 364 were Early Learning Centre stores.

Having turned its attention to digital, Mothercare’s UK online sales now account for 25.5% of total UK sales. Last year online sales made up 32.7% of total sales. Mobile is responsible for 84% of online traffic and 61% of online sales.

It is clear from looking at the reduction in store count, the growth in overseas markets and the rising online sales, that Mothercare’s strategy for turning the business around was the right one. Given the current and ongoing challenges facing the high street at the moment, Mothercare will need to continue to innovate and use technology to continue to set it apart from its competitors in order to remain a sustainable business going forward.

|

|

|

|

eSports and Competitive Gaming – Gotta Catch Em All! |

| |

Posted At: 22 July 2016 14:56 PM

Related Categories: Retail, Social Commentary |

| |

Following the news that Game has opened its first eSports and competitive gaming zone at its Manchester Trafford store and the eagerly awaited launch of Pokemon Go, FSP takes a look at the impact gaming is having on our lives and the wider retail industry.

Gaming has been a feature of many people’s everyday lives right from the release of the very first console - The Magnavox Odyssey – in 1972 through the years to the release of consoles from the major video game companies such as Atari, Nintendo, Sega, Sony, Microsoft.

Over the years, the consoles have evolved to match the changing needs of the gamer, providing a lucrative business for the likes of Game when consumers want to upgrade their consoles to get the latest release and upgrades. These changing needs have also brought about the evolution of online gaming, mobile gaming apps and virtual reality headsets, a long way away from the very first consoles ever produced, and yet more ways of making money, be it through in-app purchases or an online subscription.

The release of the mobile app Pokemon Go recently has been so well received it has surpassed all expectations from its makers. From the young to the old, Pokemon Go has people running down the road trying to ‘catch them all’, and it’s getting children outside and off of their normal consoles. This could be a good thing.

The gamer is definitely here to stay, and retailers will need to stay one step ahead in order to capitalise on this market. Game could be on to a winner; providing space where people can compete against each other while in a shopping centre environment and adding another leisure dimension to the standard shopping trip. Whether it is a success or not remains to be seen.

|

|

|

|

Retail Update - June 2016 |

| |

Posted At: 16 June 2016 15:27 PM

Related Categories: Administrations, Retail |

| |

Since our last update, Austin Reed has failed to attract a buyer and its entire physical portfolio will cease trading by the end of June 2016. BHS is heading down the same route in what has been a sad month for the high street.

Consumer confidence is still just in negative territory despite having increased two points since April, and far below the levels seen last year. Brexit is playing a big part and given that the important EU referendum takes place next week on June 23rd, we await to see what impact this has on confidence.

May saw the contribution of online to overall sales grow as that of stores fell, suggesting a movement away from in-store shopping as more than a fifth of UK retail sales took place online in May for the fifth month in a row. Retailers saw growth in all categories online.

However, the percentage of online retail sales made through tablets and smartphones fell in the first quarter of 2016, the first decrease since etailing association IMRG’s records began in 2010. Just under half of online retail sales were completed through mobile devices during the period, down from 51.3% in the fourth quarter of 2015.

With the rising use of contactless payment methods, it comes as no surprise that debit cards are poised to overtake cash as the UK's most popular payment method in five years' time, the payment industry's trade body Payments UK has forecast. Current rates of growth indicate there will be 14.5bn payments made on debit cards in 2021 compared with 13bn cash payments. Cash usage will continue to decline past this date to account for just over one in four payments by 2025. The data showed that cash currently remains the most popular payment method in the UK, accounting for 45% of the 38bn payments made last year.

It will be interesting to see if online continues to outpace the high street, and how retailers respond to the changing retail landscape. SnapShop aims to keep you up-to-date with all of the news and latest in shopping habits.

|

|

|

|

Retailer Spotlight – New Look |

| |

Posted At: 08 June 2016 00:58 AM

Related Categories: Retail, Retailers |

| |

Having started life a teen fashion retailer in 1969, New Look has come a long way since its humble beginnings; from upping its game to offer clothing to a more mature woman, branching out into menswear and standalone men’s stores, and expanding internationally. All things of which have led to New Look to report a significant year in its latest accounting period.

For the year to the end of March, New Look reported underlying profits of £174.7m on the back of sales of £1.5bn; an improvement driven by multichannel, menswear and “continued success” in China. Online sales soared for New Look, with own website sales up 27.9% for the year and third party online sales increasing 41.8%.

The year saw New Look open six standalone menswear stores, and a further two stores since year end – all of which are “trading well” - and New Look is on track to open 20 new stores by the end of March 2017.

China has certainly been a success story for New Look where it has opened a further 66 stores over the past year, and it now trades from 92 stores in the region having opened another seven stores since the end of March. The next year will see New Look open another 50 shops in China where demand for its product is high.

Having been sold to Brait in May 2015, New Look has certainly flourished over the past year, making continued progress against its strategic initiatives to develop into a truly global brand.

|

|

|

|

Retail Update - May 2016 |

| |

Posted At: 19 May 2016 17:13 PM

Related Categories: Administrations, Retail, Retailer At Risk, Retailers |

| |

Since our last update, when BHS and Austin Reed Group had negotiated CVAs, both have now succumbed to administration. Although both have attracted a lot of interest, no announcement has yet been made regarding the future of these iconic brands.

Consumer confidence has also taken a bit of a knock since our last update, falling back into negative territory, as consumers show concern regarding Brexit and the wider Eurozone crisis. It will be interesting to see if this figure remains stable as we approach the EU referendum.

With the recently released Android Pay in the UK, data from the UK Cards Association has revealed that monthly contactless spending in the UK has reached a record high. A whopping £1.508bn was spent through contactless payments in March. This figure, despite security concerns surrounding contactless, looks destined to rise as the choice of options continues to grow for consumers.

As online continues to grow, footfall continues to decline, down 2.4% in April , following a 2.7% decline in the previous month. High streets saw the biggest decline with footfall down 4.7%, while shopping centre footfall edged down 0.7%. Retail parks, however, saw an uplift of 1.1%.

Interesting data from the Publishers Association was released in April that revealed sales of print books are rising for the first time in four years, while eBook sales were down for the first time since the e-reader hit the shelves. Total sales of book and journal publishing were up to £4.4bn in 2015.

In the same way, according to the latest figures from Kantar Worldpanel for the 12 weeks to 10 April 2016, physical stores are taking customers back from e-retailers in the physical entertainment sector. The figures found that high street and grocery stores accounted for 69.8% of sales, compared to 67.5% the previous year.

These are both significant to the retail industry as the battle for online against physical retailing heats up, and demonstrate that although online is clearly an important strategic market for retailers, consumers still want (and need) that ability to physically be able to enter a shop and feel and see the product in their hands before buying.

You can keep up to date with the latest consumer trends and shopping habits here on SnapShop.

|

|

|

|

Retail Update - April 2016 |

| |

Posted At: 21 April 2016 16:00 PM

Related Categories: Administrations, Retail, Retailers |

| |

With the CVAs of Beales and BHS approved last month, April saw Scottish independent Xile Clothing fall into administration and subsequently rescued by JD Sports-owned Tessuti.

Austin Reed Group – which underwent a CVA last year to shed stores and restructure its operations – was acquired by Alteri Investments, having appointed advisers to find a way forward for the struggling chain almost a year to the day it’s CVA was approved.