|

|

Retail Update - February 2018 |

| |

Posted At: 20 February 2018 17:15 PM

Related Categories: Administrations, Retail Statistics, Retailers |

| |

The start of 2018 has been a rocky one for retail.

• Restaurant insolvencies increased by 20% in 2017 with 984 entering administration, up from 825 in the previous year, according to accounting and advisory network Moore Stephens, who also said the last 10 years have seen an “unprecedented” level of openings creating an “over restauranted” market

• January saw a raft of closures among both casual dining and independent restaurants, including a CVA of Jamie’s Italian and Byron and the administration and subsequent closure of Square Pie

• The latest figures from the Coffer Peach Business Tracker show Britain’s managed-pub and restaurant chains saw collective like-for-like sales 0.6% ahead in January despite widespread doom and gloom

• Similarly, nearly a fifth (19%) of clothing retailers in the UK are showing “early warning signs” that they are at risk of going insolvent, according to Moore Stephens. Out of 35,078 fashion retailers, 6,580 were found to show early signs of financial distress, such as a large fall in revenue or poor payment history

• According to the latest data from Kantar Worldpanel, total physical entertainment sales dropped 8.8% in the 12 weeks to January 14, with video dragging down the average with a 21% drop. Physical music sales also saw a decline of 5.8% but the resurgence of vinyl sales helped offset the decline - now accounting for 10% of physical music sales

• Sales across UK retailing have been largely flat in January, the latest ONS figures show

• Ecommerce saw a slowing in growth from 19.1% this time last year to 9%, accounting for 16.5% of all retail sales, down from 18% in December

• According to the annual ‘Shopper Stock Take’ report from Shoppercentric, shoppers are adjusting their buying habits – over a quarter (26%) of UK shoppers report having noticed prices increasing a lot, while 56% say they have seen small spikes. Consumers primarily put these increases down to the state of the economy (54%) and Brexit (50%), although the exchange rate, cost of ingredients and ‘greedy’ companies are also blamed by a fair proportion of shoppers

What remains to be seen is how the rest of the year pans out – FSP and SnapShop are on hand to keep you up-to-date and provide assistance to you and your centres.

|

|

|

|

Retail Update - June 2017 |

| |

Posted At: 16 June 2017 11:39 AM

Related Categories: Administrations, Retail, Retail Statistics, Retailers |

| |

May was a month of change on the high street. German womenswear brand Basler fell into administration; Joy was bought out of administration by its owners in a pre-pack deal; and Edinburgh Woollen Mill acquired the Jaeger name. Additionally, Edinburgh Woollen Mill embarked on a new department store concept, Days, which launched in a former BHS store in Carmarthen.

Household spending growth slowed in May as British shoppers selectively cut back purchases, as the rise of inflation threatens living standards. According to Barclaycard figures, spending was up 2.8% on the year, which marked the slowest rate of growth since last July. The British Retail Consortium’s (BRC) study of shops’ sales found growth slowed to 0.2% on the year, a substantial slowdown from the strong Easter spending in April.

The BRC’s Online Retail Sales Monitor also found that e-commerce sales grew at their slowest rate for more than four years in May. Online sales of non-food products grew by 4.3% in May – down from 13.7% a year earlier and at its lowest level since the BRC analysis started in December 2012. The three-month average stands at 7% – also the lowest the BRC report has yet recorded.

This slow-down both online and on the high street in May could have been the result of a pre-election and pre-Brexit blip. However, according to the long-running and closely-watched GfK Consumer Confidence Index, consumers’ confidence in May stood at -5, two points up compared to -7 in April, suggesting that this isn’t the case.

Interestingly, Payments UK – the trade association for the payments industry – has forecast that debit cards will overtake cash as Britain’s most frequently used method of payment by 2018 thanks to the rise in contactless cards. Worldpay, which handles 40% of all UK card transactions, said that spending on all forms of contactless systems now accounts for 28% of all non-cash transactions in the UK, with total spend exceeding £10b for the year in 2016.

However, the Bank of England’s chief cashier and director of notes has said cash payments were “very much alive and kicking” and that contactless and electronic payments were not a threat. Victoria Cleland highlighted how technology has had a “huge impact”, with ways to pay including digital currencies, mobile payments and innovations such as contactless cards gaining “real traction”. But contrary to predictions of the eventual death of cash, Cleland said “if we dig further, it is clear that cash is very much alive and kicking”.

|

|

|

|

Retail Update - May 2017 |

| |

Posted At: 19 May 2017 16:32 PM

Related Categories: Administrations, General, Retail Statistics |

| |

Following on from the administrations seen in March, April saw one high-profile retailer fall – that of Jaeger. Administrators announced the closure of 20 stores and the loss of 253 jobs shortly after Easter, and as yet, a buyer has not been found for the chain.

The high street benefitted in April from the late timing of Easter as evidenced by the figures from the Office for National Statistics. UK shoppers bought 2.3% more in April than they did in March. On an annual basis sales grew by 4%, helping to buoy the economy after a weak March - retail sales in the three months to April were up 0.3% compared with the previous three-month period. This suggests shoppers are not cutting back despite rising inflation, which climbed to its highest level in three and a half years to 2.7% in the 12 months to April, driven by the fall in the pound and consequent increase in the cost of imported goods.

E-commerce sales also grew by 19% in April, with shoppers collectively spending £1bn a week online during the month - accounting for 15.6% of all retail spending, excluding automotive fuel. That’s up from a 14% share last year.

Not surprisingly, footfall was also up in April. Figures from the British Retail Consortium and Springboard’s retail footfall monitor reveal that footfall in high streets was up 2.3% while footfall in retail parks climbed by 2.7%. However, footfall in shopping centres edged down 0.6%.

Continuing the Easter effect on the high street, figures from the Coffer Peach Business Tracker show that managed pub and restaurant groups were back in growth in April, with collective like-for-like sales up 4.4% compared with the same month last year.

In other news, the surge in openings of low-cost fitness clubs has driven gym usage in the UK to a record high. Memberships last year rose from 9.2 million to 9.7 million, boosting penetration from 14.3% to 14.9%, equivalent to one in seven people. According to the 2017 State of the UK Fitness Industry Report, the number of fitness facilities grew by 4.6% to 6,728 in the 12 months to the end of March. The number of budget gyms passed 500, with the sector now accounting for 15% of the market’s value but 35% of private sector memberships. The value of the market as a whole is estimated at £4.7 billion, up 6.3%, with the sector set to reach several milestones in the next 12 months: £5 billion by value, 7,000 gyms and 10 million memberships. All of which is good news for those involved in finding innovative use for retail space.

|

|

|

|

Retail Update - April 2017 |

| |

Posted At: 26 April 2017 10:20 AM

Related Categories: Administrations, Retail, Retailers |

| |

March saw three high profile retailers hit the buffers:

-

Agent Provocateur – subsequently bought by Four Marketing through a pre-pack deal

-

Brantano

-

Jones Bootmaker – the majority of its business was subsequently sold to private equity Endless, which acquired 72 stores as part of the deal

According to insolvency firm Begbie Traynor, almost 23,000 retailers reported significant financial stress in the first three months of 2017 as cost pressures continue to mount. Further administrations have been predicted by the firm, which has reported a 4% rise in retailers under financial strain compared to the same period last year.

The ramifications of the business rates reforms, announced last month, have yet to be fully felt in the industry. Mixed with increased price competition, a weak pound, dwindling consumer spending and a rise in minimum wages, analysts expect a 'large number' of retailers to fail in the coming months.

However, it is not all doom and gloom on the high street.

A record number of overseas tourists travelled to Britain during the first two months of 2017, up 6% on the same period last year, according to new figures published by VisitBritain. The 5.2 million visits also resulted in a record spend of £2.7b in January and February, a year-on-year increase of 11%.

London’s luxury market was also boosted by a momentous return of Russian visitors and Americans’ surge in interest for British luxury in the first quarter of the year. International tax free shopping data for London Luxury Quarter, which covers Mayfair, St James’s and Piccadilly, showed growth of 39% in the period. In addition, Russian visitors’ tax free shopping spend rose by 88% in March while American spend grew by 116% year-on-year.

Online continues on its steady upward trajectory, with UK shoppers spending £1bn a week online in March - 19.5% more than they did in the same month last year. That total accounts for 15.5% of all retail spending, excluding fuel, during the month, and contrasts with 13.6% a year ago, according to the Office for National Statistics’ Retail Sales report for March 2017. However, consumers are getting harder to please when it comes to online shopping (see FSP View).

It will be interesting to see what the next few months have in store for retail and consumers, as we head towards a general election. Whatever happens, SnapShop will keep you up to date with the latest news.

|

|

|

|

Retail Update - December 2016 |

| |

Posted At: 16 December 2016 12:40 PM

Related Categories: Administrations, Retail, Retailers |

| |

As we rapidly head towards the end of 2016, it has been pleasing to see that no administrations have been recorded on SnapShop since our last update.

November was the month for Black Friday – see our previous blogs – and the start of discounting as retailers geared up to capture the all-important Christmas spend. In fact, recent research from Deloitte has found that for the sixth consecutive year, consumers are enjoying bigger pre-Christmas discounts than they did in the previous year. Analysis of over 300,000 products currently for sale in the UK reveals that discounts are currently averaging 43.3% - some 1.5% deeper than at the same time last year.

Despite all the discounting, retail footfall in November edged down 1% on the same month last year following a 0.9% drop in October, and retail sales only edged up 0.6% year-on-year. and GfK’s Consumer Confidence Index dropped 5 points to -8. As has been seen throughout the year, the leisure industry has remained resilient and November was no different - like-for-like sales in managed pub and restaurants grew by 1.1% against 2015, with London providing the biggest increase.

London has been a talking point as it remains an attractive destination for new UK retail entrants. According to new research from CBRE, over 75 new retail entrants opened in London in 2016, with the prime streets in Mayfair and Chelsea proving to be a magnet for luxury brands.

Interestingly, a new report has predicted that travel hubs will be the most favoured location for new stores in the coming year. (0912) This doesn’t come as much of a surprise to FSP, when new figures have shown that like-for-like retail sales at Network Rail managed stations grew by 3.5% from July to September. This equates to total sales of over £166 million, up from £160 million in the same period last year.

What remains to be seen is how retail will fare for the remainder of the year and who will be the winners and losers over the festive season. SnapShop will bring you all the news on this in January.

In the meantime, we wish you all a very Merry Christmas and a Happy New Year

|

|

|

|

Retail Update - November 2016 |

| |

Posted At: 18 November 2016 00:29 AM

Related Categories: Administrations, Retail, Retailers |

| |

Since our last update, SnapShop has recorded three administrations:

-

Betta Living appointed administrators as rising rents pushed the company into a loss, and put pressure on cash flow

-

American Apparel in the UK called in administrators from KPMG. The failure of two American Apparel UK companies, American Apparel (UK) Ltd and American Apparel (Carnaby) Ltd comes as the US company is being sold. The UK operation, along with some European parts of the business, is not part of the sale

-

Bakery chain Cooplands collapsed into administration after its CVA failed, and was subsequently acquired by Cooplands Retail Limited, formerly associated with the same directors as Alison's Coffee Shop, which had traded as Cooplands since its initial administration last year

Despite what some would see as doom and gloom on the high street in terms of the rise in administrations reported over the past two months, and the news that Gap’s Banana Republic fascia is exiting its store presence in the UK, October’s retail sales grew at their highest rate since April 2002. Coupled with strong online growth throughout the month and backed up with GfK’s Consumer Confidence Index, the trend for buying now seems set to continue as we head towards Black Friday and Christmas.

Indeed, with many retailers now having launched their festive campaigns to entice shoppers and the grocers heading into battle over toy price matching schemes, it will be interesting to see if the big four can reclaim some lost ground over the discounters as we head towards the end of the year.

In other high street news:

With the crazy Christmas season upon us, FSP will be monitoring the news closely to see who is making a success of the latest retail evolutions.

|

|

|

|

Retail Update - October 2016 |

| |

Posted At: 20 October 2016 16:45 PM

Related Categories: Administrations, Retail, Retailer At Risk, Retailers |

| |

Since our last update, bakery and catering company Peyton and Byrne has gone into administration following the loss of contracts at London’s Kew Gardens and the British Library. The bakery business has been sold as a separate entity to Peyton and Byrne Bakeries Limited, a new business owned by the Peyton family, and its five existing public catering contracts have been sold as part of a pre-packaged sale to foodservice company Sodexo.

As seen in August, September has painted an equally rosy picture on the high street:

-

Data from IMRG Capgemini’s eRetail Sales Index shows that September’s online performance topped off a strong quarter, with the Index recording the highest quarterly growth at 17% since the first quarter of 2014

-

According to the latest Coffer Peach Business Tracker, consumer spending on eating and drinking out continues to hold up post-Brexit, with managed pub and restaurant groups reporting collective like-for-like sales up 1.8% in September against the same month last year, with those outside the M25 reporting bigger increases than those in the capital

-

Consumer confidence rebounded to pre-Brexit levels in September, with GfK’s long-running Consumer Confidence Index increasing by six points this month to -1 (30/09)

In other news from the high street:

-

The UK stationery market is set to rise by 2.4% to around £2.1 billion by 2021 according to research from Verdict Retail

-

Consumer confidence rebounded to pre-Brexit levels in September, with GfK’s long-running Consumer Confidence Index increasing by six points this month to -1

-

The post-Brexit crash in the value of the pound means that the UK is now the cheapest market in the world for luxury goods according to research from Deloitte

And finally, Mintel predicts UK Christmas sales will rise 2.5% to £42.2bn this year but this depends on retailers’ approach to the all-important Black Friday. It will be interesting to see the strategies surrounding what has become one of the most important festive shopping dates on the calendar, something we at SnapShop, will keep you up-to-date with.

|

|

|

|

Retail Update - September 2016 |

| |

Posted At: 20 September 2016 10:54 AM

Related Categories: Administrations, Retailers |

| |

No administrations have been reported since our last update; in fact many retailers seem to be announcing ambitious expansion plans along with those making their debut in the UK such as Australian retailer Typo.

August has been a pretty buoyant month for retail;

-

Data from the Office for National Statistics has shown that sales dipped by 0.2% in the month, indicating that the EU referendum result have had minimal impact on consumer confidence. The ONS said that the underlying pattern for the retail sector over a longer period remained “one of solid growth"

-

Figures from the IMRG Capgemini eRetail Sales Index revealed that online sales grew fast in August, with shoppers spending £9.8bn over the internet. That’s 16% more than in the same month last year

-

Glorious summer weather has seen pubs outperform restaurants according to figures from the Coffer Peach Business Tracker, which saw like-for-like sales across managed pubs and restaurant groups grow 0.6% in August, following on from 0.3% growth in July. According to the analysis of sales at 34 firms, pubs saw like-for-like sales up 1.2% compared to a 0.4% decline in casual-dining sales

-

GfK’s Consumer Confidence Index rose by five points in August to -7, after dropping by the fastest rate in 26 years in July following the Brexit vote

In other news from the high street;

-

According to the British Retail Consortium’s (BRC) annual Payments Survey, cash was used in less than half of all retail transactions across the UK last year, with the use of cash falling to 47.15% of all retail transactions in 2015, compared to 52.09% in 2014.

-

The Spotlight: Retail Revolutions report, published by Savills and intu, has revealed that shoppers in Newcastle and Birmingham spent more on fashion over the last 12 months than those in any of the UK’s other major cities, with an average spend of £304 and £313 per head respectively. Meanwhile, shoppers in Bristol spent the least, at just £184 per head

-

Cushman & Wakefield's UK Shopping Centre Development Report forecasts that new retail space from shopping centre openings and revamps will reach a four-year high in 2017. More than 2.7m sq. ft. of additional floor space is under construction and due to open next year.

All things point to the fact that – for the time being at least – consumers in post-Brexit, pre-exit UK are still willing to spend, with retailers still expanding and evolving to meet the changing needs of their target market, and shopping centres are still being built. Perhaps the death of the high street has been exaggerated, as some recent reports have suggested. FSP aims to keep you up to date with all of the latest news from the high street.

|

|

|

|

Retail Update - July 2016 |

| |

Posted At: 21 July 2016 16:16 PM

Related Categories: Administrations, Retail Marketing, Retailers |

| |

A lot has happened since our last update – 52% of the UK decided we would be better off out of the EU; BHS has started closing stores as no buyer has been found; Taking Shape has shut all UK stores and appointed a liquidator to its UK subsidiary; My Local fell into administration; and, Store Twenty One is looking to close 82 stores having had its CVA approved.

Brexit has certainly ruffled feathers throughout the UK as a whole. GfK ran a one-off Brexit special online with 2002 respondents between 30th June and 5th July 2016, in which GfK’s Consumer Confidence Barometer core Index fell 8 points to -9. All of the key measures used to calculate the Index fell. This long-running survey dates back to 1974, and there has not been a sharper drop than this for 21 years (December 1994). It will be interesting to see how this Index fairs over the coming months as plans start to emerge surrounding the future of the UK and our position in Europe.

In other news, over 30 new towns have applied to Business in the Community’s programme to revitalise high streets, including Falmouth, Falkirk, Barrow-in-Furness, Huddersfield and Maidstone, bringing the total enrolled to 100. The programme, which launched in 2014, aims to increase footfall by 10%, reduce the number of vacant properties by 20% and stimulate the creation of new jobs.

A study of 30,000 consumers by British Land and Verdict has found that 89% of all UK retail sales in 2015 touched a store through physical sales, click & collect or online sales browsed in store. The research found that this boosts physical retail by 5% and further demonstrates how physical and online complement each other, something that we at FSP have always maintained.

Internet sales continue on the upward trajectory, seemingly unfazed by the Brexit decision. Shoppers spent 17% more online in June than they did at the same time last year, and IMRG said that it had so far detected only a short blip after the poll. While smartphone spending soared, growing in June by 69% year-on-year, sales made over tablets grew by just 0.4%.

Finally in environmental news, Oxford Street is set to be pedestrianised by 2020, with all traffic banned as part of mayor Sadiq Khan’s plans to tackle air pollution.

|

|

|

|

Retail Update - June 2016 |

| |

Posted At: 16 June 2016 15:27 PM

Related Categories: Administrations, Retail |

| |

Since our last update, Austin Reed has failed to attract a buyer and its entire physical portfolio will cease trading by the end of June 2016. BHS is heading down the same route in what has been a sad month for the high street.

Consumer confidence is still just in negative territory despite having increased two points since April, and far below the levels seen last year. Brexit is playing a big part and given that the important EU referendum takes place next week on June 23rd, we await to see what impact this has on confidence.

May saw the contribution of online to overall sales grow as that of stores fell, suggesting a movement away from in-store shopping as more than a fifth of UK retail sales took place online in May for the fifth month in a row. Retailers saw growth in all categories online.

However, the percentage of online retail sales made through tablets and smartphones fell in the first quarter of 2016, the first decrease since etailing association IMRG’s records began in 2010. Just under half of online retail sales were completed through mobile devices during the period, down from 51.3% in the fourth quarter of 2015.

With the rising use of contactless payment methods, it comes as no surprise that debit cards are poised to overtake cash as the UK's most popular payment method in five years' time, the payment industry's trade body Payments UK has forecast. Current rates of growth indicate there will be 14.5bn payments made on debit cards in 2021 compared with 13bn cash payments. Cash usage will continue to decline past this date to account for just over one in four payments by 2025. The data showed that cash currently remains the most popular payment method in the UK, accounting for 45% of the 38bn payments made last year.

It will be interesting to see if online continues to outpace the high street, and how retailers respond to the changing retail landscape. SnapShop aims to keep you up-to-date with all of the news and latest in shopping habits.

|

|

|

|

Retail Update - May 2016 |

| |

Posted At: 19 May 2016 17:13 PM

Related Categories: Administrations, Retail, Retailer At Risk, Retailers |

| |

Since our last update, when BHS and Austin Reed Group had negotiated CVAs, both have now succumbed to administration. Although both have attracted a lot of interest, no announcement has yet been made regarding the future of these iconic brands.

Consumer confidence has also taken a bit of a knock since our last update, falling back into negative territory, as consumers show concern regarding Brexit and the wider Eurozone crisis. It will be interesting to see if this figure remains stable as we approach the EU referendum.

With the recently released Android Pay in the UK, data from the UK Cards Association has revealed that monthly contactless spending in the UK has reached a record high. A whopping £1.508bn was spent through contactless payments in March. This figure, despite security concerns surrounding contactless, looks destined to rise as the choice of options continues to grow for consumers.

As online continues to grow, footfall continues to decline, down 2.4% in April , following a 2.7% decline in the previous month. High streets saw the biggest decline with footfall down 4.7%, while shopping centre footfall edged down 0.7%. Retail parks, however, saw an uplift of 1.1%.

Interesting data from the Publishers Association was released in April that revealed sales of print books are rising for the first time in four years, while eBook sales were down for the first time since the e-reader hit the shelves. Total sales of book and journal publishing were up to £4.4bn in 2015.

In the same way, according to the latest figures from Kantar Worldpanel for the 12 weeks to 10 April 2016, physical stores are taking customers back from e-retailers in the physical entertainment sector. The figures found that high street and grocery stores accounted for 69.8% of sales, compared to 67.5% the previous year.

These are both significant to the retail industry as the battle for online against physical retailing heats up, and demonstrate that although online is clearly an important strategic market for retailers, consumers still want (and need) that ability to physically be able to enter a shop and feel and see the product in their hands before buying.

You can keep up to date with the latest consumer trends and shopping habits here on SnapShop.

|

|

|

|

Retail Update - April 2016 |

| |

Posted At: 21 April 2016 16:00 PM

Related Categories: Administrations, Retail, Retailers |

| |

With the CVAs of Beales and BHS approved last month, April saw Scottish independent Xile Clothing fall into administration and subsequently rescued by JD Sports-owned Tessuti.

Austin Reed Group – which underwent a CVA last year to shed stores and restructure its operations – was acquired by Alteri Investments, having appointed advisers to find a way forward for the struggling chain almost a year to the day it’s CVA was approved.

All is not doom and gloom on the high street though. Consumer confidence – although possibly starting to reveal Brexit fears – is still positive and the average house price continues to grow, reaching over £200,000.

A new initiative aimed at making UK high streets some of the most digitally enabled in the world has launched, starting with pilots in Cheltenham and Gloucester. The digital high street programme is led by Home Retail Group chief executive John Walden and supported by businesses including IBM, Boots UK, Google, Lloyds Banking Group and Facebook. Additional locations already carrying out limited digital initiatives elsewhere will be included in the project, with the aim of launching the high street digital hub nationally in spring 2017.

Online continues on its steady growth path, with Mintel research revealing that nearly half of all British grocery customers shop online, with over 11% never visiting brick and mortar stores. Not surprisingly, total online sales grew by 11% in March, with smartphone sales growing by 101%. Sales via tablets were up by only 6%, the IMRG Capgemini eRetail Sales Index showed.

Interestingly, a survey of Co-operative Group shoppers has revealed that 65% of shoppers from a sample of 2,000 it interviewed thought they would only need a mobile phone to pay with by 2025. As it stands, two-thirds of all transactions at The Co-op stores are still made using cash, despite the Co-op being the first retailer to roll-out contactless payment points in 2014.

You can keep up with all the latest trends on SnapShop.

|

|

|

|

Retail Update - March 2016 |

| |

Posted At: 29 March 2016 00:27 AM

Related Categories: Administrations, Retail Statistics, Retailers, Store Closures |

| |

The past month has seen a bit of turmoil on the high street, although no administrations have been recorded on SnapShop.

BHS proposed a CVA at the beginning of March which was subsequently approved this week to enable it to reduce rents in 40 loss-making stores as it looks to continue to trade through its turnaround plan.

Beales also filed for a CVA at the beginning of March for 11 of its 29 stores, seeking a rent reduction of 70% on 11 stores for 10 months while it negotiates with landlords. The other 18 stores – including its flagship in Bournemouth – are unaffected.

Recent weeks have seen plans to extend Sunday trading hours rejected by MPs, meaning that all will stay the way it has been on the high street. Many see this as a victory, while others see it as a disappointment. FSP can see both sides of the coin, and we wonder whether this is something that will be addressed again in the future as we move further into the digital world.

With the news that Google is bringing Adroid Pay to the UK soon, Barclaycard research has shown that contactless spending in 2015 soared by 188% in pubs and bars. The category experienced the third biggest rise in 'touch and go' transactions over the past year behind public transport (532%) and pharmacies (207%). Contactless spending in fast food outlets was also up 108%. Restaurants witnessed a 104% increase and caterers, ranking 10th on the list, saw a 96% uptake in the speedy payment method. This is definitely something to watch in the coming months.

Another addition to the ‘ones to watch’ list, is that a wave of American retailers is predicted to cross the pond and use London as a launch-pad into European expansion. Research from BNP Paribas has forecast that brands such as Michael Kors, America Eagle Outfitters, Henri Bendel and Tory Burch, as well as new market entrants, will be among the US retailers drawing up expansion plans, seeking to capitalise on the buoyant consumer environment in the UK.

|

|

|

|

Retail Update - February 2016 |

| |

Posted At: 24 February 2016 00:42 AM

Related Categories: Administrations, Retail, Retail Property, Retail Statistics |

| |

No administrations have been recorded on SnapShop since our last update.

Brantano, which was placed into administration in early January, was acquired by its former owner Alteri Investors in mid-February. Some 58 stores and concessions were not included in the Alteri acquisition. It will be interesting to see what happens with this retailer in the future, as it seeks to become more of a multichannel player with a slimmed down store portfolio.

The high street doesn’t seem to have been affected by the so-called ‘January Blues’ this year; indeed UK retail sales surged the most in more than two years in January, boosted by demand for clothing and computers. Pub and restaurant groups have continued their strong growth seen last year, with collective like-for-like sales in January up 1.9% on the same month last year, according to latest figures from the Coffer Peach Business Tracker.

A rather notable trend that emerged from 2015 was the soaring sale of gift cards. Figures from the Gift Voucher Shop, the company behind the One4all Post Office Gift Card, revealed a 35% increase in sales, online sales via One4allgiftcard.co.uk saw a 60% increase compared to 2014, and gift card orders for rewards and incentives via the corporate division, One4all Rewards, soared by 47% on the previous year.

According to the data, fashion retailers saw the largest value of One4all Gift Card redemptions during the 2015 Christmas period and overtook general merchandise stores which were number one in 2014.

FSP will be watching with interest as new trends emerge in 2016. Our understanding of retail helps our clients make informed investment, development and asset management decisions.

|

|

|

|

Retail Update - January 2016 |

| |

Posted At: 26 January 2016 10:40 AM

Related Categories: Administrations, Retail, Retailers |

| |

Since our last update Christmas has come and gone and we have the first retail casualty of 2016 – Brantano. Having been loss-making for a number of years, Brantano’s demise was not unexpected. Macintosh Retail Group sold Brantano and sister company Jones Bootmaker to Alteri in November 2015 who subsequently appointed advisers to look at options for the chain.

Similarly, and a little more of a surprise, was Blue Inc’s announcement that it was putting its subsidiary A Levy Ltd into administration and closing 74 stores to restructure the business for profitable growth.

It remains to be seen what will happen with either of these retailers – and indeed if any others will succumb to administration – but SnapShop will bring you the news as it is reported.

2015 was a good year on the whole. Consumer confidence increased in December and the whole year showed positive scores for the first time in its history; London welcomed a record number of international tourists last summer with more than 5.2 million visits between July and September; and pub and restaurant groups continued their strong growth – the underlying long-term trend shows that like-for-like sales for the whole 12 months of 2015, up to the end of December, were ahead 1.5% on 2014.

It will be interesting to see what trends 2016 will bring and how our high streets will fare.

Indeed, a new proposal from Fragmented Ownership to revive shrinking high streets has launched following the release of data that shows footfall in the UK’s town centres is continually declining. Fragmented Ownership, a group of property experts and investors, argues that town centres need "investment zones" run by a single body that would be able to offer a package, rather than a disparate collection of shops. Let’s see if this latest revival plan manages to achieve something where others have failed.

|

|

|

|

Retail Update - December 2015 |

| |

Posted At: 17 December 2015 16:24 PM

Related Categories: Administrations, Retail, Retailers |

| |

December has again been quiet on the administration front with nothing recorded on SnapShop.

Rumours have been flying around concerning the future of BHS, but with their recent high profile appointments we will be keeping a close eye on them as Retail Acquisitions continues to turn the chain around.

The news continues to focus on last month’s events surrounding Black Friday, Cyber Monday and Manic Monday and the fact that many retailers are firmly now in Sale mode for the remainder of the year as they continue trying to entice shoppers into their stores. However, Mintel has predicted a 4% rise in retail sales to surpass the £42.5bn mark in December.

Interestingly, research by Allegra World Coffee Portal has forecast that the UK's coffee shop market will be worth over £15bn by 2020 with over 30,000 outlets. Its findings show that sales at the UK's 20,700 coffee shops grew 10% in the last year to £7.9bn. In the past year customers are estimated to have drunk 2.2bn cups of coffee out-of-home. Costa topped the sales chart with an estimated 169m cups sold.

Business rates are another focus of the news, citing significant increases in bills when the review happens in 2017. Research from Colliers International suggests that 76 of the UK's main towns and shopping centres will see an increase in their business rates bill, with some parts of London seeing an increase of more than 400%.

What will happen remains to be seen, but this, along with the implementation of the National Living Wage, is sure to be playing on retailers’ minds.

Lastly, nearly two in three British towns have seen their numbers of pubs, bars, restaurants and clubs rise or stay the same in the last year, the latest edition of the licensed trade’s Market Growth Monitor from AlixPartners and CGA Peach has revealed. This is good news as the festive season is in full swing, helping to breathe life back into UK town centres.

You can keep up-to-date with how retailers fare over the festive period on SnapShop as the all-important rent quarter day rears its head again.

|

|

|

|

Retail Update - November 2015 |

| |

Posted At: 20 November 2015 16:30 PM

Related Categories: Administrations, Retail, Retailers |

| |

October has been a fairly quiet month in terms of administrations, with the exception of Garage Shoes which underwent a pre-pack administration saving jobs and stores.

Not surprisingly much talk recently has been about the impending Black Friday next week and what retailers plan to do with it. See FSP View for our thoughts on this particular shopping day.

The general feeling this month is that things are improving on the high street and throughout the country. The British Retail Consortium is predicting that festive sales will see a healthy growth compared to last year. It’s not just the UK that is seeing an upturn, Retail Ireland is forecasting that Irish retailers will have their best Christmas in seven years following an increase in consumer sentiment.

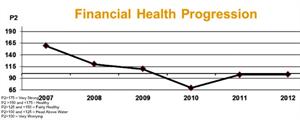

Consumer confidence has remained in positive territory throughout 2015 in contrast to the loss reached between mid-2007 and early 2014 when the recession was at its height. It will be interesting to see if it remains this way in the run-up to Christmas and in the New Year.

The eating and drinking out market seems on a never-ending course of growth. Collective sales for managed pub and restaurant chains were 2.5% up against October 2014. This level of growth is perhaps unsurprising given the recent JLL report that reveals F&B operators have doubled the amount of floorspace they take in shopping centres over the last ten years.

The plans to relax Sunday trading laws could be knocked off course by the Scottish National Party who intend to vote against them over fears it could drive down wages in Scotland. Not everyone is on board with the plans, both retailers and members of parliament, although from the press it seems like the government is keen to pursue this.

It has been interesting to read that the Healthy High Streets scheme, which launched last year and is backed by a group of the high streets’ leading retailers, has been deemed a success in its first year. Perhaps lessons can be learned from the initiatives implemented and introduced in other areas to help revive further ailing high streets.

|

|

|

|

Retail Update - October 2015 |

| |

Posted At: 22 October 2015 15:32 PM

Related Categories: Administrations, Retail |

| |

Although there have been no recorded administrations on SnapShop again this month, all is not necessarily well on the high street. Quiksilver and American Apparel, who both filed for Chapter 11 bankruptcy in the US, have secured new financing packages enabling them to exit bankruptcy and restructure their operations ; and, Sports Direct and Direct Golf are currently locked in a legal battle of ownership for the golf brand.

Concern is also rising over the proposed changes to Sunday trading laws, with a number of MPs opposing the relaxation of hours, and new figures from Bira have revealed that traditional independent retailers have closed more stores than opened them in UK town centres in the first half of 2015. There was a net loss of 144 independent stores (0.14%) across all sectors in the first six months of this year, compared with a net increase of 289 stores (0.28%) for the same period in 2014.

But it is not all doom and glooms. The latest set of figures from the Office for National Statistics reveal that retail sales rose by 6.5% in September year-on-year despite average store prices falling by 3.6%, and supermarket price wars have left the average household better off by £58 a year, according to Kantar Worldpanel.

Figures released by the British Retail Consortium and Springboard in their monthly footfall monitor show that retail footfall in September was 0.2% lower than the same month a year ago. The figures show that high streets and shopping centres experienced declines of 1.4% and 1.3% respectively. Despite the fall, this was best performance recorded by high streets for seven months.

Interestingly, the eating-out sector is booming, with the managed pub and restaurant groups recording steady growth throughout 2015, boosted by new openings.

The latest Barclaycard Consumer Spending Report found that consumer spending in pubs had risen by 11.6%, and restaurants by 12.6% between 23 August to 26 September, marking the sector's 26th month of consecutive double-digit growth.

Black Friday looms again next month, with shoppers expected to spend at least 30% more on Black Friday and Cyber Monday this year, compared to 2014. It will be interesting to see if this is realised and if retailers have learnt from their mistakes last year.

|

|

|

|

Retail Update - August 2015 |

| |

Posted At: 21 August 2015 00:31 AM

Related Categories: Administrations, Retail |

| |

There have been no recorded administrations on SnapShop since our last update. Many retailers are in fact embarking on expansion plans, both in the UK and abroad, to take advantage of an upturn in the economy, improving consumer sentiment and town and shopping centre redevelopments.

Research from Visa has revealed that spending by Chinese tourists in the UK increased by 45% in July compared to the same period last year after visa rules were relaxed at the start of the month. People from China spent £50m on Visa cards in the UK during July, overtaking French and Australian visitors to become the second highest spending tourists to the UK, according to figures from the credit card giant. Only Americans spend more while travelling in the UK than the Chinese, splashing £140m on Visa cards last month, up 16% on the year earlier.

With a number of retailers using pop-up shops to showcase new products or as a test-bed for opening a permanent store in a new location, it is interesting to read that pop-up retail is now worth £2.3bn to the UK economy and employs 26,000 people. According to Britain’s ‘Pop-Up Retail Economy’ from the Centre for Economics and Business Research, the report, commissioned by EE, found that pop-ups now account for 0.76% of total UK retail turnover, more than £200m in sales up on last year. The research reveals that the pop-up retail sector is growing at 12.3% largely due to a rise in the number of customers and an increase in average spend.

Britain’s F&B market continues to grow, with the latest figures from the Coffee Peach Business Tracker revealing that collective like-for-like sales for the managed pub and restaurant market grew 1.1% in July. The Tracker numbers show that total sales in July, which include the impact of new openings, were ahead 4.8% across the market as a whole. Within that, restaurant chains contributed a 9.2% total sales increase against July 2014, with a 12.3% increase outside the M25.

This trend is backed up by a report by Aviva, which shows an increasing demand for casual dining. Chains such as Nando’s and Giraffe are helping to revive regional high streets and shopping centres, whilst consumer demand for the likes of Gourmet Burger Kitchen, Strada and Carluccio’s remains strong and is set to continue to expand, reducing vacancy rates and pushing up rents in the UK’s high streets and shopping centres.

|

|

|

|

Retail Update - July 2015 |

| |

Posted At: 23 July 2015 16:49 PM

Related Categories: Administrations, Retail, Retailers |

| |

There have been no administrations recorded on SnapShop since our last update. In fact, much of the news reported recently has been very positive and concerns retailers across the spectrum announcing ambitious expansion programmes throughout the UK and abroad, and retailers making their debut in the country, such as Australian stationer Kikki.K looking to take on the likes of Paperchase.

Increasing retailer confidence is backed up by soaring consumer confidence in the UK, with GfK’s latest Consumer Confidence Barometer reaching its highest level in 15 years, rising six points in the month to 7. (30/06)

The general improvement in the UK economy is also evidenced by a 32% fall in retail administrations this year. According to research by Deloitte, (07/07) in the first six months of this year, 45 retailers entered into administration, compared with 66 in the first six months of 2014. This year’s figure is less than half the total of the 95 retailers that went into administration in the first six months of 2013, signalling much improved conditions on the high street.

The proposed changes to Sunday trading hours are hoped to bring about a similar effect on the UK high streets and boost the economy even more. They have been received well by many retailers, despite some independents having their concerns regarding competition. Research from the New West End Company, which represents 600 retailers in London’s West End, found that an extra two hours of trading on a Sunday would boost central London businesses by £260m each year and provide more than 2,000 additional full-time retail jobs. (17/07)

Interesting research from the British Retail Consortium has revealed that despite a slight decline in use, cash continues to account for over 52% of all transactions.(02/07) The study found that the average value of transactions across all payment methods fell again this year as shoppers become less reliant on large weekly shops and instead make more frequent visits to a wider variety of stores. It also reveals that UK customers are increasingly embracing non-traditional methods to pay for their shopping. The use of products other than cards and cash (payment via app etc.) has expanded six-fold over the last five years but still only represents a small proportion of the payments landscape. Given the launch of Apple Pay (13/07), which allows shoppers to pay for a wide range of goods and services with their phones, it will be interesting to see what changes are highlighted in next year’s research.

|

|

|

|

Retail Update - June 2015 |

| |

Posted At: 18 June 2015 16:19 PM

Related Categories: Administrations, Retail |

| |

There has been one administration since our last update – Sphere and Turret. After struggling with financial difficulties it was announced in May that all 16 stores across central Scotland had closed. No further news on this has been reported.

Although this year has been quiet so far on the administration front, figures from FRP Advisory reveal that over 700 shops were shuttered last year with the loss of almost 5,000 jobs as a result of high street retailers such as Phones 4u, Jane Norman and La Senza falling into administration. Just 42% of the 1,270 shops that fell into administration last year were rescued, up from the 35% survival rate for stores in 2013. Back in 2011 there was a 67% survival rate for stores that entered administration.

Following April’s highest level of consumer confidence since 2002, GfK’s UK Consumer Confidence Index for May showed a decline of three points to 1, suggesting that the public are “not too confident about economic life under the Conservatives”. It will be interesting to see what the Index reveals next month.

Internet sales continued on their upward trajectory, recording their second consecutive month of double-digit growth in May according to the IMRG Capgemini e-Retail Sales Index. Total online sales increased by 10% year-on-year in May and by 2% on April.

Interestingly, UK retail accounts for 11% of global Internet retail sales, and the UK has the highest e-commerce spend per person of any country.

Online sales across the UK, US, Germany and China will grow by £320bn between now and 2018, increasing the value of the online market to £645bn, according to research by OC&C Strategy Consultants, PayPal and Google. Their research shows that Brits are currently spending nearly £1 in every £5 of their shopping via the web and the new survey suggests that ecommerce will continue to flourish. 59% of online sales are now through smartphones or tablets in the UK, in the US this number is 45% and in Germany it’s 24%.

According to Global Blue, international spend is back to strength for 2015 following a slowdown in growth last year, with London’s West End reaping the benefits. Spend in the West End is up 4% YOY to date, following a 3% YOY decline in 2014, as shoppers from top spending nations China, Middle East and South East Asia are shown to be spending over a third (38%) more in the capital’s top shopping district.

This is in contrast to the latest figures from the Office for National Statistics for the year to April 2015 which noted a drop in tourists from regions including Europe, the Middle East and Russia and showed the UK’s earnings from international visitors fell 7% to £6.7bn during the year.

However, Global Blue is predicting a significant uplift in Middle Eastern spend across the UK as shoppers flock for the annual pre-Ramadan rush. The figures show that spend from Middle Eastern nations climbed by 43% year-on-year over the rush in 2014 and the trend is expected to repeat this year. Saudi Arabian shoppers are forecast to lead the surge with spending up by 28% year-on-year to date with the Qataris expected to follow.

|

|

|

|

Retail Update - April 2015 |

| |

Posted At: 24 April 2015 11:00 AM

Related Categories: Administrations, Retail, Retailers |

| |

Continuing the trend seen last month there have been no reported administrations on the FSP Retailer Database, signalling improved sentiment in UK shoppers. This is evidenced by GfK’s Consumer Confidence Index being at its highest level for almost 13 years at +4, having recorded a rise of eight points in just three months.

The timing of Easter this year has been credited with improving footfall across retail parks and shopping centres in a month that marked the best overall footfall performance since March 2014. In the same way, managed pub and restaurant groups also reported a much improved performance over the four-day weekend according to the Coffer Peach Business Tracker.

Not surprisingly, online sales have also grown with figures in the IMRG Capgemini e-Retail Sales Index revealing growth of 9% year-on-year in March. This meant that the index recorded only single-digit growth for each month in the first quarter of 2015 which is the first time this has happened in any quarter.

According to a Barclays report, shopping on mobile devices is expected to hit £53.6bn by 2025, up from £9.7bn currently, with mobile to account for 42% of all retail sales. However, only one in five top 250 retailers around the world say they are able to fulfil cross-channel demand profitably, a report by PwC and JDA shows. The biggest challenge is to meet customer expectations, particularly over next-day delivery. The highest costs associated with omnichannel were handling returns from online and store orders (cited by 71% of respondents), shipping directly to the customer (67%) and shipping to the store for customer pick-up (59%). Nevertheless, most planned to invest an average of 29% of their total capital expenditures for 2015 on improving their omnichannel fulfilment performance, as 71% of respondents said omnichannel fulfilment is either a high or top priority for their businesses.

In other news, research by Strutt & Parker has revealed that the amount of committed shopping development in the UK has shot up 60% in the past six months, with a total of 5.1m sq. ft. now under construction. And research from Cushman & Wakefield has shown that Russia has overtaken France as Europe’s largest shopping centre market with total shopping centre stock climbed to more than 17.7 million m2 at the end of last year, overtaking France’s 17.66 million m2 of GLA. The UK followed Russia and France as Europe’s third-largest market with 17.1 million m2.

What remains to be seen is what impact the upcoming general election will have on consumer confidence and the UK economy as a whole, and if this upward trend of increasing positivity continues.

|

|

|

|

Retail Update - February 2015 |

| |

Posted At: 25 February 2015 11:26 AM

Related Categories: Administrations, Retail, Retail Statistics, Retailers |

| |

FSP’s retailer database has recorded one administration since our January update, bakery retailer Cooplands of Doncaster. Cooplands underwent a pre-pack administration process which saw the closure of 39 stores and the loss of 300 jobs. ReSolve acquired the remaining 42 shops.

Given the trend for most retail failures to occur during the first quarter of the year, one administration in February isn’t bad going. We will wait to see what March brings.

Dubai-based vegetarian fast-food franchise Just Falafel closed down its UK operations this month following a change in the company’s overall direction and strategy worldwide, although the company has not ruled out a return to the UK market.

Highlighting the ever-changing ways consumers like to shop and the evolution of mobile commerce, the Banking Moving Forward study by Experian reveals that a third of the UK population believes that credit or debit card payments will no longer be the preferred method of payment in 2020 and that paying with smartphones will take over.

Continuing this increasing trend of mobile shopping, a study by Paypal and Ipsos has revealed that mobile shopping is growing at nearly four times the rate of overall online spending in the UK and is poised to overtake traditional online shopping. They predict that mobile spend will grow at a rate of 36% from 2013 to 2016, while overall online spend will grow by 10%. Smartphone shopping only accounts for 8% of online spend, while shopping on tablets accounts for only 6%. In comparison, laptops, desktops and notebooks together account for 86% of all online shopping.

Having been the topic of many discussions over the last year, and still rearing its head in the national press, recovery on the high street still "hangs in the balance" as a huge number of town centre leases approach expiry in the next few years, Deloitte has warned. Shop vacancy rates in the North were more than twice those in the South and the situation looks likely to be exacerbated by the vast number of leases that are scheduled to expire by the end of the decade with little prospect of renewal.

The latest British Retail Consortium and Springboard footfall monitor show that Britain’s high streets suffered a 1.6% fall in footfall in January as shoppers continued to turn to out-of-town locations, which increased by 1.5% compared to the same period a year ago. Shopping centre footfall also fell by 2.6%. The BRC said the rise was a sign of "strong" consumer confidence, as it suggested that more consumers were happier to splash out on big ticket items, particularly furniture, and is evidenced by a five point rise in GfK’s UK Consumer Confidence Index.

|

|

|

|

Retail Update - January 2015 |

| |

Posted At: 28 January 2015 10:00 AM

Related Categories: Administrations, Retail, Retailers |

| |

Since our last update, and indeed since the start of 2015, there have been two administrations recorded on SnapShop – Bank and USC – with Austin Reed announcing a Company Voluntary Arrangement and store closures.

Looking back over the past three years, the first quarter has been consistently the biggest period for retail failures, and it is believed that 2015 could see even more companies collapse:

There are several reasons why January is notorious for this - retailers who may have been struggling prior to the festive period will most likely have been given a period of grace to turn performance around. Banks and suppliers will be watching like hawks, poised to pull the plug if and when they sense that hasn't happened. The quarterly rent date occurs on December 25, and VAT is due on January 31, meaning it is a particularly punishing time for cash flows.

December on the whole marked a positive end to 2014 despite having seen its slowest month of growth since 2008. Figures from the BRC-KPMG Retail Sales Monitor show that retail sales edged up 1% on a total basis. Sales on a like-for-like basis, however, were down 0.4% as Black Friday pulled forward some festive sales into November.

New figures from the IMRG Capgemini e-Retail Sales Index revealed that online sales grew by 14% to £104 billion in 2014. The figures also show that annual online spending broke the £100 billion barrier for the first time. For 2015, IMRG and Capgemini are forecasting growth of a further 12% with total online sales estimated to be worth £116 billion by the end of the year. In the eight weeks to 27 December, UK shoppers spent £21.6 billion on gifts and bargains which was 13% more than the same time last year.

Global Blue has revealed that international spending from tourists in the UK reached the highest level on record for December in 2014, breaking the previous year’s record by rising a further 11% on the 40% year-on-year increase seen in December 2013.

Further highlighting the success of 2014, research by CBRE revealed that investment in UK shopping centres had reached its highest level in nine years. In 2014, £5.6bn of investment transactions were completed in the UK shopping centres, an increase of 33% on the £4.2bn transacted in 2013 and well above the ten-year average of £4bn per annum. 2014 saw some landmark transactions with the largest deal being Land Securities’ £656m purchase of Lendlease’s 30% stake in Bluewater.

|

|

|

|

Retail Update - December 2014 |

| |

Posted At: 18 December 2014 15:12 PM

Related Categories: Administrations, Retailer At Risk, Retailers |

| |

With Christmas fast approaching, it is pleasing to note that other than Mexx – which had very little UK presence left following financial troubles in 2008 and has now been declared bankrupt – no administrations have been recorded on the FSP Retailer Database since the demise of Phones 4U in September. However, Austin Reed teeters on the brink, having appointed Deloitte to work on a strategic review of the business after it made a £1.29m loss in the year to January 2014. Owner Darius Capital Partners is thought to be in discussions with the auditor over a company voluntary arrangement.

Confidence has certainly showed a marked improvement since Christmas 2013, with research by IGD forecasting that spending on Christmas food and drink will increase by 1.2% this year to £20bn. The study also stated that £1bn will be spent via online; that £1.5bn will be spent via discounters, and that only three out of 10 consumers are planning on doing a traditional ‘big Christmas shop’.

Supermarket price wars have continued to intensify over the course of the year, with Aldi and Lidl making record market share gains as the traditional ‘big four’ grocers battle to keep afloat and attract consumers.

November saw the fastest month-on-month growth in online sales in the 14-year history of the IMRG Capgemini e-Retail Sales Index, rising by 37%. Year-on-year, online sales increased by 20% to mark the biggest growth rate in 2014 so far. The figures show that in the year-to-date online retail sales are up 15% and following a strong start to December with Cyber Monday, this figure is expected to reach 16% at the end of the year. Overall, an estimated £12.1 billion was spent online in November, with an average basket value, excluding travel, of £78, attributed in the main to this year’s Black Friday sales success – sales were up 44% in the week commencing 23 November alone, compared with the previous week.

Staying with the online growth trend, the numbers of click-and-collect orders are forecast to surge by 49% over this year’s Christmas period according to Barclays research, representing a rise of 5.7 million consumers.

In other news, Hereford's multi-million pound retail complex - The Old Market - has been crowned as the UK's best new shopping centre at the BCSC Gold Awards, London is to see more than 10m square feet of retail space in new developments with new shopping centre sites including Croydon, Battersea and Earls Court and extensions at Westfield London and Brent Cross malls helping to accelerate the supply of new stores, according to the latest Colliers Central London Retail Health Check report.

|

|

|

|

Retail Update - November 2014 |

| |

Posted At: 21 November 2014 00:59 AM

Related Categories: Administrations, Retail |

| |

No administrations have been recorded on SnapShop since our last update, although it has emerged that the demise of the former mobile phone retailer Phones 4U will cost the UK taxpayer £78 million.

The UK is currently gripped in a frenzy of releasing Christmas advertising campaigns as each retailer vies for customer spend, with some even deciding now is the right time to launch their very first. This is most evident in the grocery sector as competition between the ‘big four’ and the discounters continues to increase.

However the grocers try to entice shoppers, it doesn’t detract from the fact that the UK grocery market has fallen into decline for the first time in 20 years, causing some concern in the sector in the lead-up to the crucial festive trading period. According to Kantar Worldpanel sales for the 12 weeks ending 9 November fell 0.2%.

Waitrose chief Mark Price has said that the ‘big four’ could be forced to start closing doors as the industry enters its most radical phase of change since the 1950s. Analysts of Goldman Sachs agree, saying that the biggest British retailers must shut one in five of their outlets in order to survive.

There is however, positive sentiment among retailers that this Christmas will be better than last year’s. According to a Barclays’ survey of 300 UK retailers, nearly 70% believe Christmas will bring better trading than last year owing to an improving economy and healthier year of trading. This compares with 52% of retailers last year who were positive on that year of Christmas trading.

This sentiment is supported by a new study by eBay and Conlumino, which predicts that UK high streets will receive a boost this Christmas due to shoppers making three additional shopping trips each to collect parcels bought via Click & Collect. It also predicts that the average Click & Collect high street visit will drive £27 in spontaneous spending back in to bricks and mortar retail units this Christmas as three quarters of shoppers will buy additional goods and services on impulse while out collecting parcels.

|

|

|

|

Retail Spotlight: Phones 4 U |

| |

Posted At: 22 September 2014 00:24 AM

Related Categories: Administrations, Retailer At Risk, Retailers |

| |

Founded in 1987 by the Caudwell Group, Phones 4 U was the UK's fastest growing independent mobile phone retailer with more than 690 stores across the UK and Northern Ireland, and an online shopping facility. On 26 September 2006, the business was sold for a sum of £1.46 billion to private equity firms Providence Equity Partners and Doughty Hanson, before later being sold on again to BC Partners in 2011.

It was announced last week that Phones 4 U is the latest high street name to succumb to administration. Looking more closely, it seems that while the major mobile phone retailer was still a profitable business, with turnover of £1bn and underlying profits of £105m last year, losing key contracts with EE and Vodafone meant that the company could no longer operate.

So, this is an unusual retail administration situation. We’ve taken a look back at the trading history of Phones 4 U, to see how the brand evolved.

On 17th September 2014 - it was reported that Dixons Carphone offered to hire the 800 people who work in Phones 4 U concessions at its Currys and PC World stores after Phones 4U went into administration two days beforehand.

15th September 2014 - Phones 4 U fell into administration after loosing their key contract with EE, soon after losing Vodafone, announcing plans to close its 550 stores

8th September2014 - Phones 4 U owner BC Partners started exploring new options for the retailer following Vodafone’s decision to not renew its contract with the firm.

4th September 2014 - The ratings agency, Moody’s, warned clients that the mobile phone retailer was under review for a downgrade, because of its debts and the loss of the Vodafone deal.

2nd September 2014 - Phones 4 U revealed that network operator Vodafone would not be renewing its contract agreement, leaving them with only one mobile network partner - EE.

19th August 2014 - Phones 4 U announced it would be looking for over 100 new stores as it prepared to close its concessions in Currys, following the merger of Currys’ owner Dixons with Carphone Warehouse.

18th July 2014 - Phones 4U launched an ad campaign entitled ‘For the future you’, developed by adam+eveDDB. The campaign was designed to highlight the knowledge that Phones 4u can provide to customers in-store; helping customers choose a phone that suits them.

22nd January 2014 - Phones 4 U owner, BC Partners, started looking at options for Phones 4 U, including a float.

31st July 2013 - The Manchester Arena was renamed the Phones 4 U Arena after the brand agreed a five-year sponsorship deal.

22nd January 2013 - Phones 4 U launched a mobile network business called LIFE Mobile later in 2013 that used the 4G services being rolled out by EE across the UK under a wholesale arrangement.

12th November 2012 - Phones 4 U appointed Johnson Fellows to handle its UK store portfolio, consisting of more than 650 outlets.

8th October 2012 - Phones 4U recorded a rise in pre-tax profits from £87.6m in 2010 to £113.4m in the year to December 31, 2011. Sales rose from £746.2m in 2010 to £773.3m in 2011 driven by sales of high value smartphones.

This is not a typical retailer’s slide into administration, as we have seen in other cases such as with La Senza and Internacionale. Instead, what we’ve seen with Phones 4 U is how vulnerable many of our retailers still are, whether it is obvious or hidden beneath an apparently successful exterior. Until this year, Phones 4 U showed all the signs of a business coping with the competition and challenges of the current high street and in particular within the mobile phone sector. With a significant store portfolio, strong online offering, a concession deal with Currys and the launch of a new mobile network business – the signs were positive.

However, the loss of three significant deals in 2014 undermined that success with huge impact. Currys owner, Dixons’, merger with Carphone Warehouse in August saw Phones 4 U facing the end of their in-store concession deal with Currys; Vodaphone decided to not to renew their contract agreement at the beginning of September; and two weeks later 4G network operator EE followed suit, leaving Phones 4 U alone, and stuck. This goes to show how fine the line is between success and failure for our retailers, even as the economy continues to recover and our high streets to stabilise. Phones 4 U chief executive David Kassler summed it up: "A good company making profits of over £100m, employing thousands of decent people has been forced into administration."

The lesson to learn here is one of strategy and future proofing. As a facilitating business, Phones 4 U relied on their partnerships and without these they didn’t have a viable proposition. Even the most seemingly successful brands need a contingency plan.

|

|

|

|

Retail Spotlight: La Senza |

| |

Posted At: 14 August 2014 00:57 AM

Related Categories: Administrations, Retailers |

| |

During its short trading life, La Senza had planned to expand its collection of stores, and elevate the brand to the ‘biggest, young fashion, lingerie retailer’. However, the company has dipped in and out of administration twice in the last three years, and, with no prospective buyers on the horizon, appointed administrators PricewaterhouseCoopers are attempting to sell the company to other retailers. Read on for FSP’s overview of the brand’s trading history and highlights of where the cracks started to show.

Reading into the details of this case, it seems that those with authority over the La Senza brand gave too much attention to planning its expansion, rather than concentrating on the offering available at its existing stores. At the end of 2013, La Senza placed a significant amount of investment into refurbishing existing stores, continuing to promote and expand the Pinkberry frozen yoghurt brand and seeking other brands to migrate to the UK marketplace, in spite of being placed into administration in the previous year. It appears that the company missed a trick to centre its resources on its existing assets, putting on hold its plans for the expansion of this brand and others.

On 18th July 2014 Drapers reported that more La Senza stores were due to close in the following few weeks, including the Bluewater, Brighton, Cambridge, Canterbury, Cardiff, Derby, Edinburgh, Kingston, Leeds Trinity, Maidstone, Northampton and Silverburn Glasgow branches. Although there had not been any formal redundancies made, it was thought that the closures would affect 130 staff in total. The company was expected to experience a gradual wind-down although administrators PwC were looking to sell the remaining stores.

16th July 2014- Since La Senza went into administration on 1st July 2014, 75 members of staff have been made redundant through the closure of 6 stores.

8th July 2014- Reports say PwC were looking at the sale of La Senza’s 55-store portfolio.

4th July 2014- 752 jobs were at risk due to the potential closure of 55 UK La Senza, and 3 Pinkberry sister stores.

3rd July 2014- La Senza was unlikely to sell as a whole, due to retailers competing to select its best stores. Alshaya UK, which bought the La Senza UK business in an all-inclusive deal in 2012, unsuccessfully tried to find a buyer early in the year.

1st July 2014- La Senza was placed in administration for the second time in two years. Theo Paphitis was interested in acquiring La Senza stores for his own brand, Boux Avenue to increase its profile.

14th February 2013- La Senza planned to double is store presence over the successive 5 years, with new look stores and a focus on the younger customer; aiming to become the UK’s biggest young fashion lingerie retailer.

21st September 2012- La Senza made a loss of £594,302, which was expected as this was the first period of trade.

|

|

|

|

Retail Update - July 2014 |

| |

Posted At: 24 July 2014 16:41 PM

Related Categories: Administrations, Retail, Retailers |

| |

Since our last update, another two retailers have succumbed to administration, and not for the first time:

- Jane Norman fell into administration for the second time in three years at the end of June. Owner Edinburgh Woollen Mill said Jane Norman would continue to operate through its website and internal concessions.

- La Senza fell into administration for the second time in two years having experienced difficult trading conditions. The North American operations and throughout the rest of the world remain unaffected by the actions taken in the UK.

What is interesting about the woes of these two retailers is that they were both acquired by their current owners by way of pre-pack administrations – a process that only last month underwent an independent review by Teresa Graham CBE which considered the full economic impact of the process and made six recommendations for reform by the insolvency industry. It will be interesting to see the fate of other retailers acquired in this manner over the coming months/years, and the effect this review of the process has on the industry.

July has seen three new retailers sign for their first stores in the UK – US luxury home furnishings retailer Holly Hunt, American pizza chain Project Pie and Spanish tapas operator Mas Q Menos.

GfK’s UK Consumer Confidence Index has moved into positive territory for he first time since March 2005. This mood is supported by Deloitte’s Consumer Tracker, which reveals that overall confidence was four points higher in the second quarter than the same period last year, with the North of England, Scotland and Northern Ireland recording a sharp rise of six percentage points from -25% in the first quarter to -19% in the second quarter of 2014.

New footfall figures from the British Retail Consortium reveal growing evidence of consumers changing the way they shop, as more people visited out-of-town destinations and fewer visited the high street or shopping centres in June.

Some interesting points have been raised over the past month in the retail industry that back-up the changing face of the UK high street, and include:

- The Key Note Report that estimates the UK sandwich and coffee shop market has grown by 34.9% in value from 2009 to 2013 as more consumers choose to ‘catch up’ over coffee rather than at the pub.

- The Pop-Up UK Study from the Centre for Economics and Business Research and EE has found that pop-up retail shops contribute £2.1bn a year to the UK economy, and currently make up 0.6% of total UK retail turnover. The sector is forecast to grow by 8.4% over the next year.

On a slightly separate note, but still talking about the future of the high street, Mayor of London Boris Johnston has announced a major new action plan – Action for High Streets – designed to boost London’s high streets. The plan includes up to £9m of funding being made available from the autumn.

|

|

|

|

Retailer Births and Deaths: Q2 Update |

| |

Posted At: 15 July 2014 00:34 AM

Related Categories: Administrations, Retailers |

| |

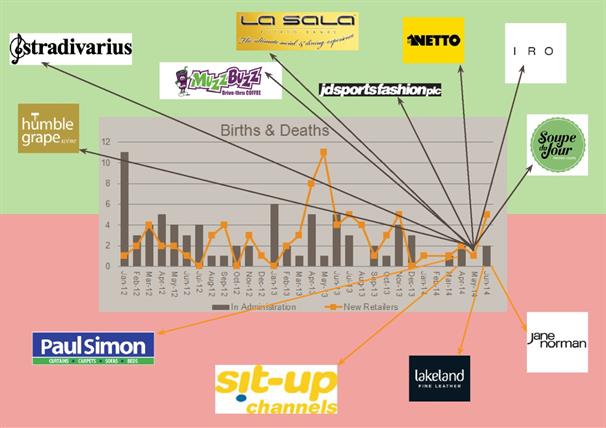

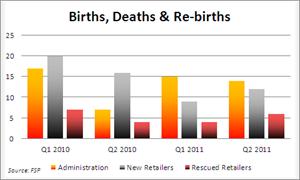

Which new names have we seen join the UK’s retail market and which retailers have fallen into administration over the last quarter to June 2014?

We’ve seen new retailers across the growing market of Food. From drive-through coffee to wine bars, there’s a lot of new names to learn in the F&B sector at the moment as international brands make their UK debuts or new retailers start up. In the ever more competitive grocery arena, discounter Netto joins the lower end of the market alongside the likes of Aldi and Lidl – which can only mean more pressure for those squeezed in the middle, like Tesco. Fashion is another sector seeing a trend of new names – a sign of growing consumer confidence as widespread terror over the state of the economy fades?

Four retailers have fallen into administration in this quarter, across fashion, TV and home furnishings. The trend is clear: those retailers who aren’t adapting to the changing shopping climate in the UK are struggling and won’t survive the competition.

In some cases, like for Paul Simon, a large part of the problem was failing to adopt an effective online offering – with their transactional website inefficient and not cost-effective. When their stores were hit by a drop in sales as a result of the flooding this year – having a strong web presence could have helped balance things out. As it was, they couldn’t weather the storm. In other cases, the problem lies fundamentally with the in-store offering as with Jane Norman. The fashion retailer has struggled for several years in the challenging and competitive sector, finally succumbing to administration for the second time in three years due to lack of a turnaround in-store, although its website will likely continue trading.

Ultimately it comes down to ‘customer experience’: both online and in-store – you can’t ignore either channel anymore – creating a unique and positive experience for your shoppers is imperative.

Let’s look at the Q2 births and deaths in more detail…

April

A balanced month: in April we saw two retailer births, while two fell into administration…

IRO

Who they are: IRO is a French young fashion brand, operating across the USA, Europe and the UAE, positioned in the upper-middle sector of the market. It currently operates concessions within department stores in the UK, including Selfridges, Harvey Nichols and Harrods.

What’s happening: IRO will make its standalone store debut this summer with the opening of a flagship store in West London. Cushman & Wakefield have been appointed to find more suitable locations around the capital as the brand looks to expand further.

In the news:

o IRO to open flagship store in Brompton Cross

Soupe du Jour

Who they are: Soupe du Jour is a new restaurant and take-away concept, co-founded by Charles Paillé de Rivière and Daniel Auner. It offers a range of traditional fresh soups with a modern twist, and is positioned in the middle of the market.